Social Security is often called "the third rail of American politics." It is

a program which puts the federal government in the position of guaranteeing retirement

money for anyone who lives 65 years. Of course the federal government is not

authorized to undertake such business, as there is nothing in the Constitution

which authorizes direct payments to individuals. Saving and investing

for a comfortable retirement is the business of banks and credit unions.

The IRS started

requiring Social Security numbers on tax returns in 1962.

Over the years the Social Security number has become a de facto national

identification number, and may end up on your

National ID Card even

though everyone was assured that would never happen when

Social Security numbers were first assigned. Back then, had the

public been able to foresee today's use of the Social Security number as a

serial number for every worker, no doubt the program would have met

with great opposition.

Over the years the Social Security number has become a de facto national

identification number, and may end up on your

National ID Card even

though everyone was assured that would never happen when

Social Security numbers were first assigned. Back then, had the

public been able to foresee today's use of the Social Security number as a

serial number for every worker, no doubt the program would have met

with great opposition.

Quoting from CPSR:

For the first few decades that SSN cards were issued, they carried the

admonition: "Not to be used for Identification." Unfortunately there was

never any law passed instituting this as a policy. The Social Security Agency

was apparently attempting to instill good values in the citizens, but was

apparently unsuccessful in preventing government encroachment into this territory.

Today, Social Security "contributions" are withheld from the paychecks of people (like me) who

are given little or no realistic hope of ever seeing that money again. It is

therefore just another federal tax. "Guarding Social Security" is a

way to buy votes, or to frighten the elderly into voting for the people who are

most likely to perpetuate the system. But the government's hollow promise

of assuming responsibility for an infinite pool of retirement money is not just

hard to believe — for young wage earners especially, it is beginning to

look like a colossal hoax and a cruel scam. With the recipients living longer and becoming

more numerous, many people consider it one of the greatest pyramid schemes of all time.

The whole notion of retirement is a relatively new concept. The Bible (that is, the

authorized King James Version) mentions nothing about retirement — apparently

we're supposed to keep working until we die.

Some of the information on this page pertains to the use and abuse of the Social Security Number

as a national identifier. More information can be found

on this page.

All the information about Medicare, Medicaid, and prescription drug benefits for senior citizens is now

on this page.

Note: Federal, state and local governments spent a total of $747.1 billion on pensions in

2006.*

Overview:

Social

Security Won't Give You Security. Social Security is going broke. When this government program was set up

in 1935, the average life expectancy was 60. But you couldn't collect your first check until you reached 65. In

other words, most people didn't live long enough to receive Social Security. And most of those who did, didn't collect it

for very long. Today, the average lifespan is 79. So now, most people do live long enough to receive Social

Security — for 10, or 20, or even 30 years. Here's another important piece of information: When the

program started, the ratio between worker and retiree was 159 to 1. That means for every one person drawing

benefits, 159 were paying in. Today the ratio is 2.8 to 1. Get that? We've gone from 159 workers

supporting every retired person to fewer than three workers supporting every retiree. And it's going down. You

don't need an advanced math degree to figure this one out: Social Security is spending more than it's bringing in.

Fake

People And Phony SSNs Had 100% Success In Getting Obamacare Subsidy, Fraud Investigation

Finds. A scathing new Government Accountability Office (GAO) report identified

rampant fraud and systemic failures in the Affordable Care Act (ACA) marketplace just as Congress

is battling over the future of Obamacare's enhanced premium subsidies. [Advertisement]

The report, released Wednesday, revealed that fictitious identities, invalid Social Security

numbers, and even deceased individuals were easily approved for taxpayer-funded subsidies.

Every single application investigators submitted using fabricated or invalid Social Security

numbers in 2024 was approved for coverage. "Republicans have sounded the alarm on the flawed

structural integrity of Obamacare and how Democrats' failed policies to temporarily prop up the

program have exacerbated fraud, hurt patients, increased the burden on American taxpayers,"

Rep. Brett Guthrie (R-KY), chairman of the Energy and Commerce Committee and one of the

members who requested the GAO investigation, said in a statement.

Massive

Obamacare Identity Fraud: 71 People Use One Social Security Number, Fake Identities, Dead

People. A new watchdog investigation found large-scale systemic failures that allow

fake identities, dead people, and massive improper use of Social Security numbers to receive

Obamacare subsidies. GAO conducted covert operations which included creating fictitious

identities. In fact, 100% of fake applicants were approved by Obamacare's marketplace as

recently as late 2024. 90% of fake applicants continue to receive coverage in 2025. The

result: Wasteful federal spending on subsidies for enrollees who are not eligible. Harm

and unexpected costs for consumers. Loss of access to medical providers and medications,

higher copays and deductibles, or forced repayment. Fake identities, dead people, and massive

improper use of Social Security numbers to receive Obamacare subsidies.

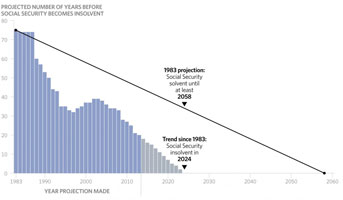

Social

Security Has Less Than 8 Years Left. I've lost track of how many blog posts I've

written about Social Security going broke. Over the years there have been quite a few and

always the news is grim. But the latest news, which came out in the form of a trustees report

published this summer says that by 2033 the old age portion of Social Security will be unable to

pay full... benefits to the millions of people who receive it. [...] Social Security is in theory a

trust fund. People pay into it through a payroll tax and, if you ask them, most Americans

have the impression that the money goes into a big bank account to hold onto it for them until they

are ready to retire. In reality, all of the money goes into the general fund and trust fund

has no separate pot of money available to it. This means the system is really a pay-as-you-go

arrangement. The money going to retirees right now is money being paid in by current wokers

plus a bit more taken from the treasury because current workers no longer cover the amount of the

payments. Payments began exceeding receipts in 2021. For some reason, Axios

decided to turn this old news into a news story last week.

Biden-Democrats

gave over 2 million illegal alien social security numbers in 2024. You know how

they keep saying that social security is going to run out of money in a few years? If it

does, it's because of [stuff] like this. Over two million illegal aliens were given social

security numbers in 2024, and nearly four million total during Biden's reign of terror. This

was of course supported enthusiastically by Schumer, Jeffries and the rest of the communist clowns. [Tweet]

DOGE:

Social Security Officially Removes 12.3 Million Individuals Listed Age 120+.

Social Security has removed from its rolls 12.3 million individuals listed as 120 years

old or older, according to the U.S. Department of Government Efficiency (DOGE). The

discrepancies in the Social Security figures and the alarming ages of some of the individuals

listed have garnered national attention over the last several months. [Advertisement] As a

result, in March DOGE began to update the American people on the massive cleanup begun by Social

Security. In a March 18 update, DOGE said Social Security had marked 3.2 million

social security number holders aged 120 or older as deceased, warning that there was still more

work to be done. [Tweet]

Social

Security Clean Up Continues, 12.3 Million Finally Marked as Deceased. After

11 weeks, the Department of Government Efficiency (DOGE) has hit a milestone in its major

cleanup initiative to remove more than 12.3 million names of Social Security number holders

whose dates of birth make them over 120 years old. DOGE team members continue to deal

with what they call "complex cases" that remain, including investigating instances where an

individual has two or more different birth dates on file. Rep. Marjorie Taylor Greene

(R-GA) touted the efforts of DOGE to root out fraud, calling the cleanup of Social Security rolls

"remarkable." [Tweet]

Trump

Blocks Illegals From Receiving Social Security After Biden Let 2 Million Enroll.

President Donald Trump signed a presidential memorandum aimed at blocking illegal immigrants from

receiving Social Security benefits, arguing that only legal American citizens should be eligible

for benefits. The move aims to remove monetary incentives for illegal aliens to come to the

United States, the White House explained in a fact sheet released Tuesday, noting that Trump has

repeatedly promised to take illegal immigrants off Social Security, and that the president signed

an executive order in February ordering taxpayer resources not be used to incentivize or support

illegal immigration. Under President Joe Biden's administration, more than 2 million

illegal immigrants were assigned Social Security numbers in just the 2024 fiscal year, the White

House said. The White House argues that the Biden administration's actions continue to steal

money and important services from American citizens.

Social

Security Launches New ID Technology to Prevent Fraud. The Social Security

Administration (SSA) has rolled out "enhanced technology" to detect suspicious activity in

telephone claims or banking changes. The new technology will strengthen identification

verification, preventing fraud. The SSA had initially planned to roll out new identity

proofing policies in March, but pushback from beneficiaries and advocates delayed it. The

policies have gone through two changes so far. So, what are these ID proofing policy changes,

and how will they affect you? Previously, Social Security recipients could call the toll-free

number to change their direct deposit bank information. But there's a problem with using the

phone. According to the SSA, approximately 40 percent of direct deposit fraud was due to

someone calling the SSA to change banking information. And although SSA employees asked

questions to verify identity, many thieves successfully stole people's funds by diverting the

benefits to other bank accounts or even Visa cards. The SSA Office of the Inspector General

(OIG) estimates that $33.5 million in benefits for 20,878 beneficiaries was misdirected from

January 2013 to May 2018.

Trump

Administration Invalidates Social Security Numbers of 6,300 Illegal Immigrants. In an

ongoing effort to curb illegal immigration, the Trump administration has quietly begun invalidating

Social Security numbers of illegal immigrants who are in the U.S. unlawfully, effectively pushing

them to "self-deport." This action is part of a broader effort to crack down on illegal

immigration and ensure that only those who follow legal procedures can access the benefits and

rights associated with a Social Security number. This week, the Trump administration

instructed the Social Security Administration (SSA) to add over 6,300 illegal immigrants to its

list of deceased individuals, effectively blocking their ability to work. The move,

instructed by Homeland Security Secretary Kristi Noem, is aimed at encouraging illegal aliens to

"self-deport" and return to their home countries. DOGE arranged for cooperation between the

SSA and the DHS. The individuals were granted to them over the years by prior administrations

despite illegally living in the United States, having criminal records, terrorist affiliations,

and/or cancelled visas.

Feds

Charge 18 Illegal Aliens with Stealing Social Security Numbers from Americans. More

than a dozen illegal aliens have been charged with stealing the identities of Americans, defrauding

the Social Security Administration in the process, Immigration and Customs Enforcement (ICE)

officials announced on Friday. According to ICE officials, 18 criminal illegal aliens were

each charged with aggravated identity theft, misuse of Social Security numbers, and false

statements regarding American citizenship with intent to engage in illegal employment. If

convicted, the illegal aliens each face anywhere from 2 to 12 years in prison.

Why

Trump Is Reclassifying Illegals Who Were Given Social Security Numbers As Dead. The

Social Security Administration is literally killing thousands of numbers that were assigned to

illegal aliens. With a Social Security number, illegal aliens can work in the United States

and receive a wide range of taxpayer-funded benefits. The Trump administration is trying to

take away the incentive for illegal aliens to stay in the United States and swiftly remove them

from the system, treating them the same as it would someone who had died. The Trump

administration is putting the Social Security numbers of more than 6,000 illegal aliens into the

same database that dead people's numbers go into, a novel maneuver that effectively strips the

individuals of their numbers and makes them ineligible for benefits. Of those illegal aliens

entered into the database for dead people, the White House said that nearly 1,000 were receiving

Medicaid benefits, while others were given student loans or collecting unemployment insurance.

Trump

Deputies Cancel Illegal Migrants' Social Security Numbers. President Donald Trump's

deputies are wiping up the Social Security Numbers that were quietly given to illegal migrants by

prior administrations. The multi-stage plan has already wiped out more than 6,300 numbers

given to migrants with criminal records, terrorist affiliations, or cancelled visas. [...] "The

goal is to cut [migrants] off from using crucial financial services like bank accounts and credit

cards, along with their access to government benefits," the New York Times reported on

Thursday. "President Trump promised mass deportations, and by removing the monetary incentive

for illegal aliens to come and stay, we will encourage them to self-deport," White House

spokeswoman Elizabeth Huston said in a statement.

A

Few Thoughts on Social Security. I began my working life at 14 washing dishes in a

truck stop just outside of Sedalia, Missouri. Yes, back in 1976 labor laws permitted

this. Fortunately it was only for the summer and then I went off to boarding school.

However. The Social Security Administration saw fit to begin taxing me for SS and Medicare

just like everybody else. I recently made the mistake of looking into the Black Box of SSA to

find out just how much I've paid into it since I started working. And without oversharing,

let's just say it's six figures. Now at age 70 (if I don't die first), the SSA will pull out

their largest eyedropper and deign to give me back a monthly stipend of my own money, totalling

$2,200. At that amount, I may recoup all of my money on my 143rd birthday. I may will myself

to live long enough to do just that.

The

Biden Regime Issued Almost 4 Million SS Numbers To Illegals, Giving Them Access To

Benefits. Biden issued nearly 4M SSNs to non-citizens, just five months after filing

asylum claims in the mail, no interview, and no ID check. As a result, they can access

benefits like Medicaid (1.3M) and get driver's licenses. [Video clip]

Five

Ways Non-Citizens With Social Security Numbers Can Scam America. When Elon Musk and

his DOGE colleague Antonio Gracias showed a Wisconsin audience how non-citizens get Social Security

Numbers (SSNs), their presentation painted the clearest picture yet of the long-term damage former

President Joe Biden's open border policy will have on the United States. Standing in front of

a huge chart, they showed how the number of SSNs issued to new non-citizens spiked in 2024. The

total SSNs issued in 2021 was roughly 270,000; in 2022 it climbed to 590,000, and in 2023,

there were 964,000 SSNs issued to new non-citizens. But in 2024 it more than doubled to over

2 million. This counts only non-citizens who got their SSNs through the Enumeration

Beyond Entry program, a system where the Social Security Administration automatically issues SSNs

and cards to certain foreign nationals in the U.S., as part of an agreement with U.S. Citizenship

and Immigration Services. [Tweet]

Trump

Administration Nears Historic Deal as DOGE Reportedly Finds Millions of Illegals on Social Security

Rolls. President Donald Trump's Internal Revenue Service (IRS) is nearing a historic

deal with the Immigration and Customs Enforcement (ICE) agency that will allow agents to more

efficiently locate and arrest illegal aliens already ordered deported from the United States.

The IRS-ICE agreement, which anonymous sources told Politico is close to being finalized, will see

the tax revenue agency open its databases to ICE agents when they need to confirm the names and

addresses of illegal aliens who have been ordered deported by a federal immigration judge.

What

the DOGErs Keep Finding at Social Security Explains the Progressive Spasms. [Indeed],

it makes you wonder if this is how the Left has been paying off their border-crossing shock

troops. If you'll remember back to last week, when Elon and the DOGE team made their first

official appearance together on Bret Baier's show, I said the segment on Social Security should be

required viewing for every little old recipient squawking about a billionaire 400 times over

trying to steal their $1500 a month check. The reason SS recipients now have to personally

come to an office to change their banking info if they wanted a bank deposit address changed was

because of the rampant phone fraud the DOGE team had uncovered almost immediately. Forty

percent of ALL CALLS were fraudulent efforts to change direct deposit info. This was

done to protect Granny, not rob her and make her life miserable. [Tweet with video clip]

Elon

Musk Says 2.1 Million Non-Citizens Got Social Security Numbers in 2024. Elon

Musk, fronting the Department of Government Efficiency (DOGE), asserts that a significant number of

noncitizens — approximately 2.1 million — acquired social security

numbers in 2024. According to the tech mogul, the number of noncitizens — believed

to be primarily illegal immigrants — attaining social security numbers has exponentially

increased over the last several years, suggesting the federal government had been aware of the

issue but chose to ignore it. The revelations were made during a town hall event in Green

Bay, Wisconsin, where Musk appeared alongside Antonio Gracias, CEO of Valor Equity Partners.

Gracias presented findings indicating that while only 270,000 noncitizens received social security

numbers in 2021, the figure surged to 2.1 million in 2024. He credited the staff at the

Social Security Administration for their cooperation in uncovering these inconsistencies.

Elon

Musk Claims 2.1 Million 'Non-Citizens' Received Social Security Numbers in 2024.

White House adviser and Department of Government Efficiency (DOGE) head Elon Musk has claimed

roughly 2.1 million "non-citizens" received social security numbers in 2024. Speaking at a

conference alongside his longtime friend Antonio Gracias, CEO of Valor Equity Partners, Musk said

DOGE uncovered some eye-opening numbers regarding social security in 2024. "We started at the

top of the system. Mapping the whole system of social security to understand where all the

fraud was. There's a lot of great people there that showed us a lot of waste, so that came

with a big list of stuff. But this is what jumped out at us," Gracias said as he pointed to

the chart. "In 2021, you see 270,000 people; goes all the way to 2.1 million in

2024. These are non-citizens that are getting social security numbers." [Tweet]

Elon

Musk Confirms Widespread Voter Fraud as Millions of Non-Citizens Get Access to Social Security,

Medicaid, and the Ballot Box. Billionaire entrepreneur and Trump advisor Elon Musk

dropped a bombshell this weekend during a fiery 100-minute town hall in Green Bay, Wisconsin, where

he campaigned for conservative judge Brad Schimel in the state's upcoming Supreme Court election on

Tuesday. Joined by Antonio Gracias, a private equity titan and a key member of the Department

of Government Efficiency (DOGE) team tasked with rooting out waste in the federal government, Musk

unveiled a shocking chart: a dramatic spike in Social Security Numbers issued to non-citizens,

soaring from 270,000 in 2021 to a mind-blowing 2.1 million in 2024. That's almost

5 million non-citizens now embedded in the system — collecting benefits, draining

taxpayer dollars, and, most alarmingly, infiltrating the voter rolls.

Inside

Social Security. In the video below Elon Musk introduces his colleague Antonio

Gracias — profiled [elsew]here by the [NY] Times earlier this month — to talk

about what he has discovered inside the Social Security Administration. [...]

MUSK: "People think that Biden was asleep at the switch. They weren't asleep at the

switch. It was a massive large scale program to import as many illegals as possible,

ultimately to change the entire voting map of the United States and disenfranchise the American

people and making it a deep blue one party state from which there would be no escape."

GRACIAS: "Human Traffickers made $13-15B off of this. This is a human tragedy. We

created a system that created an incentive for people to come here and get taken advantage of by

these traffickers."

MUSK: "This is not made up by the right. This is

absolutely true... The real reason for these attacks and the burning of the cars, is that we're

going to turn off the payments to illegals... I think this is the biggest voter fraud in the

history of America by far. If the machine behind the Kamala puppet had won then they would

have legalized all the illegals and there would be no swing states."

Elon

Musk and DOGE Team Reveal that Nearly Half of Social Security Calls are from "Fraudsters" Stealing

Social Security Benefits. Elon Musk and the Department of Government Efficiency

(DOGE) crew have revealed that 40% — nearly half — of the phone calls the

Social Security Administration receives are from "fraudsters" who are changing beneficiaries' bank

information to steal benefits. "When you want to change your bank account, you can call

Social Security. We learned 40% of the phone calls that they get are from fraudsters," one of

Musk's prodigies stated. President Trump's DOGE head, Elon Musk, and members of his team sat

for an interview with Bret Baier, which aired on Thursday evening, to discuss the waste, fraud, and

abuse in government spending that they've uncovered in just two months. Musk explained that

unscrupulous individuals "call in, they say, they claim to be a retiree, then they convince the

Social Security personnel to change where the money is flowing."

You'll

Never Guess Whom WaPo Blames for Decades of Bad Management at 'Crumbling' Social Security.

[C]onservatives have been talking about the dumpster fire at the Social Security Administration

(SSA) since at least the Reagan era. Now we discover in the Washington Post that the

real problems emerged at the agency when Donald Trump and Elon Musk arrived in D.C. ten

weeks ago. The Post wants you to believe that before Trump and Musk arrived, Social Security

was a thriving, well-oiled machine with no problems or waste. There were no 200-year-old

people on the government dole; they were only there as placeholders. No checks were going out

to those people, we were assured! But what ho! We discover on Tuesday on the pages of

the Post, that the outfit that looks to be a Ponzi scheme, which is always just a few years away

from insolvency because there's no "lock box," or real "trust fund," is now "crumbling."

Expert

turns tables on Dem critics after Musk accuses Social Security of being 'Ponzi scheme'.

Democrats have pushed back after Elon Musk claimed that social security operates like a "Ponzi

scheme" as he continues to argue for cuts to the federal bureaucracy, but one expert tells Fox News

Digital that Musk is on track with his criticism of the agency. "Musk's statement about

Social Security being the world's biggest Ponzi scheme does have validity," James Agresti, president

of the nonprofit research institute Just Facts, told Fox News Digital in response to pushback from

Elon Musk's claim, which included a "false" rating from Politifact. "A Ponzi scheme operates

by taking money from new investors to pay current investors. That's the definition given by

the SEC, and contrary to popular belief, that's exactly how Social Security operates."

DOGE:

12M 'Aged 120 And Older' Found Listed In Social Security Database. The Department of

Government Efficiency (DOGE) has reported that over 12 million people 120-years-old and older

were found to still be listed in the U.S. Social Security database. On Tuesday, DOGE posted

an update on their website, revealing that out of over 12 million individuals aged 120 and up

in their records, approximately 3.2 million have now been classified as deceased.

Social

Security Administration says it's identified $800M+ in savings. The Social Security

Administration (SSA) said in a release that it has identified more than $800 million in

savings or "cost avoidance" for fiscal 2025 among information technology, grants, property and

payroll. The SSA stated that it froze hiring and "drastically" cut back on overtime, saving

about $550 million. The government agency that administers the Social Security program

said it cut back $150 million from the information technology systems (ITS) budget by

canceling "non-essential contracts and identifying reductions in other ITS contracts." Acting

SSA Commissioner Lee Dudek said Monday evening the agency has "operated on autopilot" for far too

long. "We have spent billions annually doing the same things the same way, leading to

bureaucratic stagnation, inefficiency, and a lack of meaningful service improvements," Dudek said

in a statement. "It is time to change just that." The SSA said it made a 70 percent

reduction in travel, saving to the tune of $10 million. The agency said it also

terminated $15 million in contracts and another $15 million in grants.

No,

the GOP Isn't Cutting Your Social Security and Medicare. Even if the GOP wanted to

cut Social Security, it couldn't do so in a reconciliation bill. [...] You can understand why the

Left has gone into overdrive opposing the budget — it attacks their sacred cows: taxing

hardworking Americans into oblivion, keeping the U.S. dependent on foreign oil while pushing Green

scams, and keeping our borders wide open to terrorists, cartels, and other criminals.

"This

Might Be The Biggest Fraud In History". Musk posted a spreadsheet of Social Security

Administration data showing "numbers of people in each age bucket with the death field set to

FALSE!" The data shows that 20.789 million Americans are collecting social security

benefits over the age of 100. [...] One X user pointed out that 2023 data showed the US population

at around 334.9 million. However, Musk's data shows 394 million names in the Social

Security Administration database. Musk responded: "Yes, there are FAR more "eligible" social

security numbers than there are citizens in the USA. This might be the biggest fraud in history."

This

Week's Theme: 'DOGE Is Not An Official Government Department'. Everyone is still

howling about DOGE. Although with as many seemingly good things and astonishing finds coming

out of them, it looks to be harder and harder for the opposition to come up with objections that

will work anyone up into a lather over what the teams are doing. For instance, the acting

head of the Social Security Administration stepped down after butting heads with a DOGE team and a

request for access to information she would have rather not granted. [...] King resigned the day

after Musk revealed his team had found some 20M dead Social Security recipients still on the roles

[sic]. A few of them were almost 200 years old, and according to a whacked and ancient SS

dataset, some of them might still be getting checks — but who knows?

Elon

Musk 'uncovers' 20M in Social Security database over age 100 — here's why they're listed

and don't get benefits. Tesla and X CEO-turned-special government employee Elon Musk

claimed to have uncovered "the biggest fraud in history" when he stumbled across more than

20 million people listed in the Social Security database as over 100 years old.

"According to the Social Security database, these are the numbers of people in each age bucket with

the death field set to FALSE!" Musk posted on X late Sunday, showing a chart of ages ranging from

zero to 369 years old. "Maybe Twilight is real and there are a lot of vampires collecting

Social Security," he joked, adding that "there are FAR more 'eligible' social security [sic]

numbers than there are citizens in the USA. This might be the biggest fraud in history."

However, Musk's bombshell has long been known by the Social Security Administration (SSA) watchdog,

which released an audit in July 2023 showing that 18.9 million people listed as

100 years or older — but not dead — were in the database.

Social

Security Fraud: Nearly 1.5 Million Americans Listed as Over 150 Years Old, 1,041

Over 220 Years Old. Elon Musk and his crack team at the Department of Government

Efficiency have been scouring federal data for signs of waste, fraud, and abuse. They may

have found something massive at the Social Security Administration. Musk shared via X on

Sunday that there are hundreds of thousands, if not millions, of Americans listed as alive in the

Social Security databases who have probably been dead for quite a while. The database

included over 1.3 million people between the ages of 150 and 159, nearly 122,000 between the

ages of 160 and 169, and over 6,000 between the ages of 170 and 179.

Acting

head of Social Security Administration resigns after dispute with Elon Musk's DOGE: report.

The Social Security Administration's acting commissioner reportedly resigned over the weekend after

a dispute with the Department of Government Efficiency (DOGE) over the Elon Musk-led group's

efforts to access sensitive government records. Michelle King, a career federal worker who

had been with SSA since 1994, quit over the DOGE disagreement Saturday and was replaced by Leland

Dudek, the Washington Post reported Monday. Dudek, who has been supportive of DOGE's efforts

to root out waste, fraud and abuse in the federal government, will serve as acting commissioner of

SSA until President Trump's pick to lead the agency, Frank Bisignano, is confirmed by the Senate,

according to the outlet.

Trump

Admin Uncovered Massive Fraud Bomb Set To Explode Left-Wing Narrative On DOGE. But a

recent investigation into the Social Security Administration (SSA) shows that not only has the left

used Americans to promote their insidious ideologies at home and abroad, but they have also allowed

abuse and fraud to run rampant in a popular social program initially intended to be state welfare

pensions for the elderly. Social Security officially began in 1935 after The Great Depression

when a 1934 estimate found that nearly half of the elderly in America lacked sufficient income to

be self-supporting. Politicians have bloviated that the pension program was depleted in

modern discussions of the SSA and its welfare programs. They blamed it on several underlying

issues, including a massive Baby Boomer generation set to retire and pull from the fund.

However, thanks to DOGE head Elon Musk, we know that the real reason the pension program is

suffering is likely due to a massive amount of fraud.

The Editor says...

According to figures release on X by Mr. Musk, the number of people receiving Social Security benefits

exceeds the population of the United States, and there are millions of recipients under the age of ten; and yet,

every Social Security administrator in the last 30 years has failed to notice. Or worse, they have

noticed but didn't want to rock the boat.

Elon

Posts Jaw-Dropping Info About 'Vampires' With Social Security Numbers Over 100 Years

Old. Elon Musk has been taking a fine tooth comb through the government finances with

his DOGE team and he's come up with some more information that's likely to raise a few eyebrows and

a lot of questions. Musk posted on X about the astonishing number of people who had active

Social Security numbers who were over 100 years old. [...] The fact that the numbers are

active in regard to people who can't be alive doesn't necessarily mean that money is going out to

them. Musk seems to be implying at least some of it is, as he talks about "vampires

collecting Social Security." But it does mean that the numbers are active, and for more people than

are in the U.S. So that means there's a big problem in the system, with these numbers theoretically

still active. Elon pointed out how this was discovered some time ago, but then nothing was

done about it.

Social

Security database has one person alive for 360-369 years, and over 1.5 million people

over the age of 150. [S]omething is seriously wrong with the database of those over

the age of 150 in this country[;] In fact, the database even has a person between the age 360-369

and over a thousand people between the age of 220-229. More than 1.5 million people, over

the age of 150 are also counted in the database an eligible for social security. [Tweet]

A

terrible, no-good, very bad day for the Swamp. [Scroll down] Musk offered

many examples of fraud, waste, and abuse. Elon said the $59 million that FEMA paid to

New York hotels to house illegal migrants this week was at double normal room

rates — even at a 100% occupancy rate. The space billionaire also announced that

DOGE found some people over 150 years old who are still collecting Social Security. "I

think they're probably dead, is my guess, or they should be very famous, one of the two," Musk quipped.

Why

Government Computers Are Such a Mess. [Scroll down] A Social Security

Account Number (SSAN) is what we usually call a "Social Security number." It should, by

definition, identify one living person uniquely. The Social Security Administration says it

never reuses an SSAN, but in 2011, it started assigning new numbers randomly within limits because

they were running out. There is a whole history of this that is interesting only to nerds,

and especially security nerds, but the gist of it is when you get a Social Security number, it has

the familiar format 123-45-6789 with a few additional rules, and it should be uniquely yours.

And yet there are Social Security numbers that are assigned to as many as eleven different people.

[...] When this was first reported, a lot of people said, "That can't happen!" Except,

apparently, it can. Now, if the data were stored in a unified database, records for a new

person with an already-used SSAN would immediately lead to an error message, and the new record

would be dumped on the floor to be manually fixed. Clearly, they aren't, and at least part of

the reason is that we don't actually have a unified database.

The Editor says...

The article above presents one of the best arguments yet against the proposed National ID Card.

DOGE

Uncovers $50B Annually Sent to People Without SSNs — Why Didn't Congress Reveal

This? $50 to $100 billion a year, that is how much has already been identified

by the White House's Department of Government Efficiency through a review of Treasury payments as

likely fraud. This amount is nothing more than identifying how much is paid monthly to

recipients who don't have a Social Security number or other government identification attached to

their files. In a world of cartels and other foreign government criminal enterprises, it is

not surprising that very smart, organized attacks have been made to steal from the American

taxpayer. After all, it is as simple as Willie Sutton's answer to the question of why he

robbed banks, "because that's where the money is." DOGE head Elon Musk has already estimated,

based upon work done to date, that there is approximately $1 trillion in fraud, waste and

abuse in the system that can be identified and prevented. It took two weeks of analyzing the

government payment systems to make this incredible pronouncement. It is surprising that the

various systems that are in place to ostensibly prevent fraud failed so spectacularly, and it is

fair to wonder if some of those in charge of them were part of the steal?

Top

federal agency with history of wasteful spending could be next DOGE target.

Department of Government Efficiency (DOGE) chief Elon Musk's efforts to clean up waste and fraud in

the federal government will soon shift its focus to the Social Security Administration (SSA) in a

move likely to create a firestorm with Democrats. The SSA, created by the Social Security Act

under President Franklin D. Roosevelt in 1935 and tasked with establishing a federal benefits

system for older Americans, will soon become a focus of DOGE, according to a report from Semafor

that was not denied by the White House when contacted by Fox News Digital. While several

Democrats — including Rep. Dan Goldman, D-N.Y., in a post on X — have

been quick to accuse this move as being aimed at slashing Social Security benefits for the elderly,

several areas with potential waste exist in the agency that don't involve cutting current benefits.

Liz

Warren and the Democrat Quest to Make Social Security a Welfare Program. [Scroll down]

The truth is that Democrats have been dreaming of eliminating the caps for contributions into the

Social Security system while maintaining caps for high-earning beneficiaries like the neighborhood

dentist and Elon Musk for a long time. They have dreamed about doing that because it will

finally and fully transform Social Security into what they've always wanted it to be: a government

welfare program. And while setting up a government welfare program was almost certainly what

FDR had in mind when he pitched his "old age insurance" to Americans back in 1935, he certainly

didn't pitch it as a welfare program.

Trump

Targets Birthright Citizenship, Tripping Immigration's Third Rail. Anyone who has

ridden a subway is familiar with the third rail. Two rails of the subway track carry the

wheels of the subway cars, but the third rail, away from the passenger platform, carries

high-voltage electricity that powers the train. Touching the third rail can result in instant

death. In the American political context, Social Security, the popular retirement program

that supports millions of retirees who are often the most significant voting bloc in every

election, has always been described as the third rail. Any politician who touches Social

Security — by proposing substantial changes such as cutting benefits, raising the

retirement age, or privatizing it — is likely to have a shortened career.

Can

the DOGE finally end mismanagement of Social Security? As a member of the

Pennsylvania House of Representatives, when we were examining potential solutions to the funding

problem of Social Security, I heard repeated comments that Social Security is an entitlement.

While in the Legislature, I was the speaker's majority appointee to the Public School Employee

Retirement System (PSERS). As vice chair of the system and its Audit Committee chair, all the

other board members and I were continuously reminded that we had a fiduciary responsibility to the

members and beneficiaries of the fund. For some unknown reason, that same standard of

fiduciary due care is not extended to Social Security recipients. When Social Security was

established, it was intended to be a self-funding system from the employer and employee

contributions. This self-funding is why Social Security is not an entitlement. The fund

is, instead, a horribly managed defined benefit pension plan — horribly managed by

legislation, not by negligence.

Actually,

Social Security can go bankrupt. It has been more than 40 years since

Congress found common ground on Social Security and implemented a series of necessary

reforms. Over that time, the discussion of Social Security has devolved into a shouting

match, an exchange of emotionally charged hyperbole in which sound bites have become more important

than stone cold facts. This environment is great for politicians who wish to duck and weave

the issue with impunity, less so for the rest of us, because nothing gets done and the problem gets

worse. Voters need to think about the role they play in the do-nothing politics of

Washington, D.C. Social Security is the most predictable crisis in human history. We

have talked about benefit cuts in the mid-2030s for years. As a result of all the talk and no

action, about half of Americans 80-years-old today will outlive the system's ability to pay

scheduled benefits. In fact, nearly half of these people will live long enough to see Social

Security serve as their sole source of income.

Improper

Social Security Payments Reach $1.1 Billion, Agency Backlog Hits All-Time High.

The backlog of payment actions at the Social Security Administration (SSA) is now at a

"record-breaking" level, resulting in the agency making over a billion dollars in improper payments

to beneficiaries, according to the SSA's Office of Inspector General (OIG). The SSA's

backlog of pending actions hit an "all-time high" of 5.2 million as of February, the OIG said

in an Aug. 8 press release, citing an analysis published in June. Pending actions at the

agency's claims processing centers that remain unresolved for a long period of time have resulted

in "larger improper payments, including growing underpayments or increasing overpayments to

beneficiaries." Overpayments put social security beneficiaries under a great burden since

the agency will ask them to pay back the overpaid amount at any time. Some recipients may not

be in a financial position to repay.

Nine

hard but necessary steps to fix our broken Social Security system. Social Security is

a giant Ponzi scheme and, like all Ponzi schemes, it will eventually fail when the cohort paying in

becomes smaller and poorer than the cohort receiving the money. It's going to take a sea change to

remedy the problem, which means re-thinking the government's role. Here's what could be done:

[#1] The Constitution has the federal government's job description, so we must defund

any federal spending that is not within that description, and the projects, whatever they are, need to

be kicked down to the state level where they either belong or taxpayer money shouldn't be spent on them

at all. As an aside, this wouldn't affect only Social Security. It includes banning all

earmarks, making congresspeople liable to the same laws everybody else obeys, and ending both so-called

"monster bills" and continuing resolutions.

[#2] The federal government must balance the budget and pay its debts, including the

worthless Treasure Notes that Social Security holds.

The above two steps sound like the end of Social Security, but they're not. There's still a

way out to protect Americans, especially those who have paid into the system (money that they could have

invested for their own benefit) and are now dependent on its returns.

Redesigning

Social Security. Without Social Security, millions would face poverty, straining

families and state and local governments, increasing inequality, and destabilizing the

economy. But Social Security isn't without its problems. It relies on a larger future

generation funding the current generation of older Americans. This model is projected to run

out of full funding between 2034 and 2037 for the Boomer generation. With the Millennial

generation larger than Gen X, the shortfall might right itself during the Gen X retirement

period. We need to explore innovative solutions beyond increasing taxes, reducing benefits,

or expanding the workforce.

Social

Security, Medicare Go-Broke Dates Pushed Back. The go-broke dates for Medicare and

Social Security have been pushed back as an improving economy has contributed to changed projected

depletion dates, according to the annual Social Security and Medicare trustees report Monday.

Still, officials warn that policy changes are needed lest the programs become unable to pay full

benefits to retiring Americans. Medicare's go-broke date for its hospital insurance trust

fund was pushed back five years to 2036 in the latest report, thanks in part to higher payroll tax

income and lower-than-projected expenses from last year.

Privatize

or Bust: What Australia Teaches Us About Social Security. Though American

policymakers balk at the word, especially within the context of Social Security, other nations that

have successfully privatized retirement savings accounts could provide a model for how we might

avert the imminent bankruptcy of our current system. For a clear picture of how such a scheme

could operate, policymakers should look to Australia. The Australian retirement system,

better known as the "Superannuation Guarantee," relies primarily on personal retirement accounts

and employer contributions for funding. Whereas in the U.S. automatic retirement withdrawals

from employee paychecks go directly into a government-managed Social Security account, in Australia

those funds are managed by a number of private providers.

Social

Security: There Will Be Consequences. Social Security provides an excellent

example of big government failing the public as a whole. For every $1 the program has ever

collected, it has generated $3 of promises that it does not expect to keep. Voters, I hope,

understand that robbing Peter to pay Paul cannot last forever. By all accounts, the public

embraces the idea of Social Security. That is fine, provided that voters realize that they

have a responsibility to monitor the programs that they create through their votes, and they accept

the consequences of allowing a government program to spin out of control. Social Security has

spun out of control. Over the past decade alone, the program has generated more than

$10 trillion in promises that it has no material prospect of keeping. Over this period

of time, the gap between what the program promises and what the program will likely be able to pay

has grown at more than double the rate of growth of the national economy as a whole.

Basically, the hole in the program's finances is growing faster than our ability to fill it.

Social

Security: A Broken Socialist Dinosaur. It seems many still harbor, or want to

perpetuate, the illusion that our Social Security system is not in trouble. [...] It couldn't be

clearer. In 10 years, with no action from Congress, everyone will begin receiving 80% of

what they are currently receiving, or promised, under the existing Social Security system.

Can anyone imagine getting a notice from a private retirement provider saying that in 10 years

all beneficiaries will begin receiving 80% of what they were promised? How did we get into

this situation? It's the wonders of government planning, of socialism. Social Security

is not a pension program based on investments. It is a government tax and spend

program. The stipends of current retirees are paid with the payroll tax of those currently

working. Because life spans have increased and population growth has decreased, there are far

fewer working now to support each retiree than was the case years ago. Socialism is always

mugged by reality.

Is

Social Security savable? Milton Friedman once observed, "If the government ran the

Sahara, in five years there would be a shortage of sand." He was right. The government

has run Social Security for more than 80 years, and now there is a shortage of security. At

this point, the experts believe that someone who is 79 years old today is likely to outlive the

system's ability to pay scheduled benefits.

Christie:

Social Security, Medicare cuts are a necessary 'political risk' in today's economy.

Former New Jersey Gov. Chris Christie (R) said it's time to take a "political risk" and

consider changes to Social Security and Medicare benefits for young people. Changes to the

programs are necessary, otherwise they could run out of money for everyone in about a decade as the

country faces a rising national debt, the presidential candidate said. "The most disgusting

part of Joe Biden's State of the Union address this year was when he stood up, and he said, 'We'll

all agree, right? We're not going to do anything to Social Security?' And both sides got up

and cheered," Christie said at conservative radio host Erick Erickson's conference in Atlanta on

Saturday. "[They're] a group of liars and cowards, because they know that in 10 years,

Medicare will be bankrupt. And in 11 years, Social Security will be bankrupt."

Social

Security is running out of money. Today in news that should shock no one:

Social Security is running out of money. Yesterday was the program's 88th birthday and

socialists were celebrating and promising to expand it. [...] In other words, promising to do

nothing will set the entire system on a course for disaster. There are really only

two ways out of this.

Buffoon

alert: WaPo staffer announces solutions for national debt crisis. For months, the

economic geniuses and budget experts at The Washington Post have worked tirelessly to come up with

ways to handle our $32 trillion debt; just look at this excerpt from an article out yesterday and

written by assistant editor Drew Goins: ["]Over the past few months, the Editorial

Board has been doing what lawmakers haven't: pulling together a plan to stabilize the national

debt.["] Let's take a look at the proposals, starting with Social Security:

["]What the board proposes is a broadening of the amount of income the Social Security tax

is levied on; a gradual increase of the full retirement age to keep up with rising life expectancy;

and a decrease in how much very-high-income households receive in benefits ... while increasing

what low-income homes get.["] They want to levy higher taxes against private employees

and employers (maybe even the retirees?) to cover an unpayable debt, but fail to suggest that the

federal employees receiving the generous pensions and healthcare benefits pay more to support the

system that rewards them the most. They suggested cutting from the top, but didn't think to

cap federal pensions.

The

World's Largest Ponzi Scheme. Americans are just beginning to see the tip of the

iceberg of their own trillion-dollar Ponzi scheme, Social Security ("SSA"). Signed into law in 1935

by FDR during the heart of the Great Depression, workers were told that Social Security was

intended to provide a safety net parallel to retirement systems that existed in Europe. The

retirement age was set at 65. Americans were required to pay into the fund through payroll

deductions their employers collected. Most Americans were "covered" by the system, and it was

later expanded to cover household workers and others who were excluded initially. The system

is structured to be a regressive income tax covering most workers' wages up to $160,200 per year,

with no limit on the parallel Medicare withholding. When FDR was garnering praise for helping

the working class, the average life expectancy in the United States was only 60.7 years. So,

while most workers would pay into the system, few would live long enough to collect benefits. In

contrast, by 2020, the average American life expectancy had surged to 78.81 years. This is

just one of the problems with the SSA's structure that has brought America to the current financial cliff.

The

Social Security dilemma. There is a structural difference between the challenges

implied by the debt ceiling discussion under consideration on Capitol Hill and the financial

imbalances of Social Security. The former is a matter of how much money Congress spent in the

past that we didn't have, while the other is a problem of how much money the program will not spend

in the future. Typically, not spending money does not drive deficits. So, there is a

bit of sleight of hand. The experts of today are worried that voters at some point in the

future might decide to pay beneficiaries scheduled benefits regardless of the program's ability to

pay them. The politicians of today on the other hand are worried that voters won't step in,

leaving a generation of voters wondering what happened to the sacred trust of which politicians are

so enamored.

Some

misconceptions about Social Security. Social Security (S.S.) is not an

entitlement. Why can't anyone, including the Wall Street Journal, get it right?

Entitlement programs are paid for by U.S. taxpayers. Those persons receiving benefits do not

pay for the benefits. Social Security is a funded program paid for by workers. Upon

retirement, they receive benefits from the program, not taxpayers. All workers pay into

Social Security (matched dollar for dollar by the employer). Self-employed persons pay double

that of an employee.

American Despotism.

According to the Social Security Board of Trustees, the program will continue to pay out more than

it collects until 2034, after which it will have exhausted its asset reserves of $2.9 trillion.

The program has a present underfunding of $13.2 trillion. It estimates up to

a 21 percent across-the-board cut in benefits for existing and future retirees to sustain

payouts. Medicare funds will be exhausted by 2026.

Social

Security is Running Out of Time and Money, What Do Biden and Trump Propose? While

Trump promised to not touch SS, Biden said he would protect SS "without any change".

Biden's "guarantee" is impossible, by existing law. The pledge to not change a thing means

automatic benefit cuts starting in 2033 according to the bipartisan Congressional Budget Office (CBO).

Biden

Fiddles While Social Security Burns. The latest Social Security annual report,

projecting that the Trust Fund will be exhausted in 2033, a year sooner than previously thought,

politely explains that the Trustees "reassessed their expectations for the economy in light of

recent developments." What recent developments, you ask? Rising inflation, declining

output, weakened GDP forecast, and worsening labor productivity. In other words, this is

another bitter fruit from President Joe Biden's poisoned economic tree.

Social

Security to become insolvent in 10 years if 'no legislative action' taken, officials

warn. Social Security trust funds are projected to become insolvent over the next

decade if lawmakers don't take legislative action to preserve the health insurance program,

according to the most recent report by the Social Security Board of Trustees. If no action is

taken, Social Security is set to become depleted by 2033 — one year earlier than

previous estimates, according to the report. The most recent projections come as lawmakers

remain split on how to fund the welfare program, and negotiations remain stalled over next year's

budget.

The Editor says...

As someone said (somewhere on the internet) recently, why is Social Security running out of money, but

the welfare state isn't? We paid into Social Security all our lives, but the shiftless

freeloaders on welfare haven't contributed a thing, and most of them are too lazy to work.

Somewhat related:

Woman,

50, faces criminal trial in France after being arrested for 'publicly insulting' President

Macron. A woman has been arrested in France and faces a criminal trial for posting a

slogan referring to President Emmanuel Macron as 'garbage' on social media. The 50-year-old,

who asked to be referred to by her first name of Valerie, was placed in police custody for the

alleged offence. She is accused of 'publicly insulting' the French President, who has

witnessed millions take to the streets in protest to his controversial move to raise the retirement

age from 62 to 64 without a parliamentary vote.

Are

Republicans Trying to Destroy Social Security? Following his State of the Union

Address, President Biden has been on the attack over the GOPs' many proposals to reform Social

Security. Before you react to the talking points, you should ask: Is there any validity

to Biden's concerns? To even the casual observer, Biden's apprehensions concerning the GOP's

Social Security reform proposals appear to ignore one basic fact — and likely the most

important one. There is not a Republican plan or even lone Republican member of Congress

pushing reductions to benefits on the scale that Social Security is scheduled to reduce checks

going to seniors on its own when the trust fund is exhausted. That is zero. In its fact

sheet, the Biden administration claims that congressional Republicans have repeatedly tried to

privatize Social Security. In reality, the last time a Republican put forward a plan to

privatize Social Security was more than a decade ago.

Beating

Democrats on Social Security Reform. The greatest myth sustaining the widespread

popularity and legitimacy of Social Security is that recipients are simply getting back what they

paid into it. Therefore, Republicans must convert this myth into reality to change the

conversation and bypass the conventional unpalatable options for saving the Trust Fund:

• Raising the retirement age.

• Raising payroll tax rates.

• Raising the current $160,200 maximum for payroll taxes.

• Raising the percentage of Social Security benefits subject to income taxation.

Each of these options is off the table because Trump, McConnell, and McCarthy know they are election-year kryptonite.

Senators

are considering raising the retirement age to 70. A group of bipartisan senators is

quietly meeting to retool Social Security before funds run out in 2032. On the table,

according to Semafor, is gradually raising the retirement age to 70 and creating a

$1.5 trillion sovereign wealth fund, which would invest in stocks. That fund would be

separate from the already existing Social Security Trust Fund. If it underperformed, Social

Security would be shored up by increasing the maximum taxable income and payroll taxes.

Social

Security is Broke, but American Taxpayers Just Gave Ukrainian Pensioners a Double-Digit Raise. As American

taxpayers paying into Social Security today stare down the barrel toward substantial cuts to their own benefits,

estimated to take place in 2034, they can at least take solace in knowing that all categories of Ukrainian pensioners

will get a 20% raise in March 2023. "As early as this March," says Ukrainian Prime Minister Denys Shmyhal, "the

government will index pensions by 20%" for about 10 million Ukrainians. Indexing the payments "is not mandatory

according to the Law of Ukraine on the State Budget for 2023," but benevolent President Zelensky has instructed them to

reprice the benefits upwards anyway. And why wouldn't he? His government is swimming in American cash.

Americans have spent more than $100 billion on aid to Ukraine. And, as the notoriously corrupt Ukrainian

government is undoubtedly well aware, money is fungible.

Cuts

Are Coming to Social Security and Medicare Whether the Politicians Want Them or Not. Social Security and

Medicare are on an "unsustainable course" and will run out of funds by 2037. That's the conclusion reached by the

General Accountability Office (GAO) and the Social Security Administration. There is no saving these programs

without massive changes. And demagoguing the issue, as Joe Biden and the Democrats are doing, only delays the day

of reckoning. To pretend these programs don't need intervention now — right now — is to play

with dynamite. The sooner we can get started, the less pain will be inflicted on senior citizens. Pain there

will be. In order to put these programs on the path to long-term viability, it will take political courage absent

from today's politicians.

Sunset

Social Security or wage world war. For those who are not in the grips of emotion, conservatives have been

warning about these entitlements, or payments made to citizens instead of to an agency, since they began with the income

tax in 1913. Our forefathers back then told people that any free program becomes an alternative to the responsible

way of doing things, so people shift their costs to the free program and soon demands expand toward infinity.

Infinite demand leads to Soviet-style collapse. Since the income tax began and funded the entitlements, government

spending in this sector has risen over a hundredfold and now is the major item in our budgets. Our economy changed

since 1950 from being free market to being government-directed because such a huge part of our economy consists of

payments from D.C. A quick look at our budget shows that of our $4.8[trillion] mandatory spending every year,

$4[trillion] of it comprises three programs — Social Security, Medicare, and welfare — and that

this swelling has caused our inflation crisis by diluting our money supply since WW II. Fast forward a few

decades and we have $32[trillion] in debt, almost all of it from entitlements. We can repay war loans but no one

can stop the slow grinding advance of the free stuff from government, and a sensible observer will note that leftism has

risen along with the entitlements. The more people who depend on the free stuff, the more people vote leftist,

especially among the young.

The

Perversion of Self Respect. When the Social Security Act was created in 1935, 27 workers paid for

every retiree. By 2035, which is not that far away, that ratio could fall to 2! And, greatly increased

Social Security benefits will not be paid without help from the U.S. Treasury and/or reducing benefits to

retirees. We need our Millennials and Gen Z generation to emulate their parents, step up, and have

financially productive careers.

Biden's Big

Lie About Social Security and Medicare. emocrats and the corporate media have often accused former

President Donald Trump of using a propaganda strategy called the "Big Lie" to convince Americans that the 2020 election

was stolen. [...] Essentially, it involves relentlessly repeating a colossal lie until the public eventually comes to

believe it. It is little wonder that the Democrats and the Fourth Estate are so familiar with this

strategy — they employ it themselves every election cycle. Their Big Lie of choice is the perennial

claim that the Republicans are plotting to gut Social Security and Medicare. President Joe Biden repeated that

yarn during last week's State of the Union address: "Republicans say if we don't cut Social Security and Medicare,

they'll let America default on its debt for the first time in our history." After being loudly booed for that

whopper, he went on to say, "If anyone tries to cut Social Security ... and if anyone tries to cut Medicare, I'll stop

them." This is an ironic assertion coming from a man who, as a U.S. senator, once bragged about his own attempts to

cut both programs.

Joe

Biden Tried to Sunset Social Security, All Other Federal Programs as a Senator. Joe Biden introduced

legislation that would sunset all federal programs, including social security, every four years when he was a freshman

United States senator in 1975. On Tuesday night at the State of the Union, Biden stated that "some Republicans"

wish to "sunset" social security and Medicare, leading to significant pushback from GOP lawmakers on the House floor

while millions watched. [...] But Biden made an even more aggressive proposal when he represented Delaware in the United

States Senate, seeking "to sunset all federal programs, including social security and Medicare," every four years, Fox

News reported, when he introduced S. 2067 on July 19, 1975. Biden's central argument for reviewing all

programs was the rapid increase of the federal budget.

Republicans

Must Take the Lead in Reforming Social Security and Medicare. The last president to reform Social Security

was Ronald Reagan. He formed the Greenspan Commission to formulate solutions to problems the program faced.

Reagan then worked with speaker of the House Tip O'Neill to enact the solutions. Social Security as we know it

would have ended decades ago had he not been successful. [...] President Reagan was not a supporter of large government

programs. In a 1964 speech, he said, "No government ever reduces itself in size. So government programs,

once launched, never disappear. Actually, a government bureau is the nearest thing to eternal life we'll ever see

on this earth." However, by the time Reagan became president, he understood that the program was embedded in the

lives of the American people, and he would better serve them by sustaining it. Reagan accomplished what seems

improbable today. He reached a bipartisan consensus.

This

simple fix could help save Social Security. Social Security Trust Funds have squandered billions of

dollars on an antiquated investment policy. That loss tells us a lot about the financial crisis coming to Social

Security. In 2019, Social Security lost roughly $1 billion because the system invests the excess reserves on

exactly the wrong minute of the year. Any other day or any minute early in the day, saves the program money.

It is 2023, and the beat goes on. Over the course of 2022, Social Security redeemed more than $100 billion in

high-yield debt, and lost nearly $5 billion in interest earnings in the process. The program just gave it

away. Here is the problem: Social Security generally needs cash to pay its bills in the back half of the

year. Unfortunately, the program locks up all its loose cash on June 30. So, starting July 1,

the program needs to redeem bonds, and the Treasury Department picks the wrong bonds for redemption based on a policy

that literally dates back to the era of black-and-white TV.

Kristi

Noem Speaks Out After Federal Agencies Leak Her Social Security Number. Gov. Kristi Noem (R-S.D.) is

demanding answers after her Social Security Number was leaked by the federal government in a document related to the

House Select Committee's investigation of the Jan. 6 protests. In a letter addressed to Rep. Bennie

Thompson (D-MS), Noem's lawyers condemned the security breach, asking to know how the agencies plan to combat the

high-risk issue. "Gov. Noem and her family are now at very high risk of identity theft and being personally

compromised due to the failure to redact the social security numbers and make the same available to the public," the

letter reads. Noem's husband, three children, and her son-in-law's Social Security Numbers were also leaked.

Social

Security Spent $250M on System It Doesn't Use. When reviewing applications for disability benefits, the

Social Security Administration consults an obsolete directory last updated in 1977, despite having spent $250 million on

a newer, more relevant one. The SSA relies on a 45-year-old job titles database, filled with jobs like "Document

Preparer, Microfilming," "Telephone Quotation Clerk" and "Nut Sorter" to deny thousands of claims a year, The Washington

Post reported. When disabled Americans apply for SSA disability benefits, they can have their applications denied

if the agency finds that they can still work in a job title listed in their directory. But many of those jobs

don't exist anymore or exist in far fewer numbers as work has become more automated, The Post reported. Jobs like

sorting nuts, inspecting dowels, and processing eggs are done by machines, yet those jobs are still listed in the old

directory and used to reject claims. And that's after the SSA spent $250 million since 2012 to build a new

directory of 21st century jobs, with the cost expected to reach $300 million.

Fact check:

Biden's midterms message includes false and misleading claims. [For example,] Biden said at a Democratic

fundraiser in Pennsylvania last week: "On our watch, for the first time in 10 years, seniors are going to get the

biggest increase in their Social Security checks they've gotten." He has also touted the 2023 increase in Social

Security payments at other recent events. But Biden's boasts leave out such critical context that they are highly

misleading. He hasn't explained that the increase in Social Security payments for 2023, 8.7%, is unusually big

simply because the inflation rate has been unusually big. A law passed in the 1970s says that Social Security

payments must be increased by the same percentage that a certain measure of inflation has increased. It's called a

cost-of-living adjustment. [...] Biden said at a Democratic rally in Florida on Tuesday: "And on my watch, for the first

time in 10 years, seniors are getting an increase in their Social Security checks." The claim that the 2023

increase to Social Security payments is the first in 10 years is false. In reality, there has been a

cost-of-living increase every year from 2017 onward.

White

House deletes 'flagged' tweet crediting Biden for Social Security pay increase. On Wednesday, the White

House was humiliated once again when it was forced to delete a tweet that had credited "President Biden's leadership"

for the bump in Social Security payments after being flagged by Twitter as being inaccurate. The increase in

Social Security checks is actually due to a 40-year high in inflation, which ironically, Biden is responsible for.

"Seniors are getting the biggest increase in their Social Security checks in 10 years through President Biden's

leadership," the White House fibbed on Twitter Tuesday. The original tweet was flagged on Twitter noting that many readers

were adding "context" to it. The White House did not say why the tweet was deleted but it was definitely noticed.

Joe

Biden Is Lying To Americans About Medicare And Social Security's Insolvency. A dozen years ago, Democrats

faced a dilemma. A long-term care entitlement known as the CLASS Act that they added to what became Obamacare

faced serious solvency concerns. But after Scott Brown, R-Mass., won a shock Senate victory for Republicans in a

January 2010 special election, ending Democrats' filibuster-proof majority, Democrats didn't have the votes to alter the

CLASS Act or remove it from Obamacare. What did Democrats do? The Obama administration suppressed the

internal documents showing that the CLASS Act wouldn't work.

Social

Security Will Allow People to Select Their 'Gender Identity' Going Forward. The Social Security

Administration announced this week that people will now be able to select the sex that most aligns with their "gender

identity" in records going forward. According to a press release from the SSA, the policy was created to be more

inclusive to "transgender" and "gender diverse" Americans. "The Social Security Administration's Equity Action Plan

includes a commitment to decrease administrative burdens and ensure people who identify as gender diverse or transgender

have options in the Social Security Number card application process," said Acting Commissioner Kijakazi in a statement.

"This new policy allows people to self-select their sex in our records without needing to provide documentation of their

sex designation."

Social

Security's 8.7% COLA Will Protect Retirees From Inflation, but Will Hasten Program's Insolvency. The

Social Security Administration announced Thursday that beneficiaries will receive an 8.7% cost-of-living adjustment next

year. That's good news for seniors today who — like all other Americans — are struggling

with rising costs, but it comes at the expense of a diminished Social Security system for current and future

retirees. Social Security is funded by current workers' payroll taxes, but since the average worker's wages

increased only 4.1% over the past year, that means Social Security's revenues have increased at less than half the rate

of its newly announced expenditure increase. Add in the fact that there are 2.8 million fewer people working today

compared with the pre-pandemic employment-to-population ratio, and Social Security's revenues are almost certainly below

trend while its costs are above trend. Even before this large COLA increase, Social Security was projected to run

out of money to pay scheduled benefits in 2034. Absent reform, that means that anyone who is 55 or younger today won't

receive a single full Social Security benefit.

Social

Security Announces Cost of Living Adjustment for 2023. The Social Security Administration announced on

Thursday that the Cost of Living Adjustment (COLA) for 2023 will be 8.7%, the biggest increase in 40 years.

Seniors will begin seeing the increase in January. The average increase in benefits will be $140, according to SSA.

Social

Security COLA update expected to be boosted significantly due to inflation. News reports say the upcoming

cost of living adjustment (COLA) for Social Security could be "huge," but the Senior Citizens League says it will still

be unfair to seniors and not enough to compensate for their actual increased expenses. "My COLA estimate has dropped

to 8.7% almost a full percentage point from the 9.6% that I forecast last month. That was a significant drop, but

the Consumer Price Index, CPI-W, the index that Social Security benefits are based on, has decreased even [more] —

by 1.10 percentage point year over year to 8.7%," noted Mary Johnson, Social Security and Medicare analyst for the League.

WaPo

gives Sen. Patty Murray 'Four Pinocchios' for saying Republicans plan to 'end' Social Security,

Medicare. The Washington Post handed down four "Pinocchios" to Sen. Patty Murray, D-Wash., for her

claim warning of the "end" Social Security and Medicare if Republicans take control of Congress. Murray, who is

fighting in a tightening reelection battle against GOP challenger Tiffany Smiley, tweeted on Sunday, "Republicans plan

to end Social Security and Medicare if they take back the Senate." Glenn Kessler, the Post's fact-checker,

characterized Murray's tweet as a "'Mediscare' attack" to win over senior voters.

Student