Taxes have been the subject of a lot of grumbling amongst the general population of every country in history, as far as I know. Tax collectors were

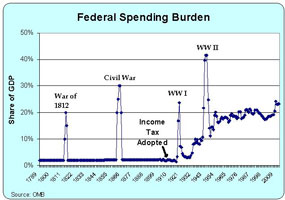

notoriously unpopular, according to the stories in the New Testament. These days, the overgrown federal government is giving away money to people who

are too lazy to work, and making many other forms of payments to individuals, all of which are unconstitutional. New types of taxes are being added

constantly, to support the bloated government's appetite, because the prospect of cutting back on spending is politically out of the question.

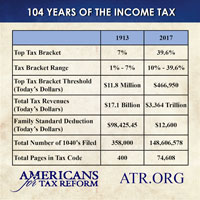

Of the many taxes we pay every week, the income tax is the most costly. Yet the income tax didn't exist until about a hundred years ago, and even the

income tax started out as a small inconvenience to the wealthiest people in America. Taxes today include numerous nickel-and-dime fees that are tacked on

to your telephone bill or the price you pay for an oil change or a set of tires.

Related topics:

Odometer taxes

Gasoline taxes

Carbon (dioxide) taxes

Cigarette taxes

Value Added Tax

Lies about taxes

The IRS

The use of the IRS as a weapon

In England:

Thousands

of pensioners could be forced to sell their homes as Rachel Reeves eyes 'distressing' new tax

plan. Pensioners could be among the hardest hit by plans reportedly being considered

by Chancellor Rachel Reeves to introduce a one percent annual charge on homes worth more than

£2 million. The proposed levy could see owners of £3million properties

facing yearly bills of up to £10,000. Experts warn that many older homeowners,

particularly those who are "asset rich but cash poor", may struggle to afford the charge.

Some long-term residents who bought their homes decades ago and have since seen property values

soar could even be forced to sell if they cannot meet the extra costs.

California

to Push for a Billionaire Wealth Tax Aimed at 180 People. California is,

politically speaking, a one-party state. Democrats have supermajorities in both the state

house and senate, which means the only thing that can stop them is stubborn fiscal reality.

[Advertisement] We saw this play out just a few months ago when California's plan to extend

Medi-Cal (the state's version of Medicaid) to illegal immigrants blew a big hole in the budget,

forcing Gov. Newsome to dial it back and borrow money. But now, some progressive

economists are teaming up with California unions for a fix that could plug the state's expected

budget shortfall for the next four years. The proposal is a billionaire's wealth tax which

would apply to as few as 180 people in the state.

When

Do We Truly Own Anything? The Property Tax Scheme That Keeps Us Paying Forever.

Every year, I write a check for twenty-four thousand dollars in property taxes. In Texas,

over half of that typically goes toward public education — sometimes up to

70 percent in certain counties. The irony is that none of it goes toward educating my

own children. I homeschool my kids. On our farm, we built a small barn with

electricity, air conditioning, and a nearby restroom. My husband and I teach our children

farming, entrepreneurship, and money management. We hire a teacher three days a week for

reading, writing, and math, and a tutor for additional help with reading. We pay entirely out

of pocket for all of it. Yet each year, I'm still forced to pay tens of thousands of dollars

to fund a system I fundamentally disagree with. I don't believe the public school system

nurtures creativity, curiosity, or courage. It creates workers, not thinkers. It

rewards compliance, not conviction. [...] It feeds them food I consider unhealthy and trains them

to fit in rather than think for themselves. Last year alone, my property tax bill increased

by eleven thousand dollars.

Exit

Taxes as the Ultima Ratio. EU citizens are not infrequently being drained by a tax

burden of 45 percent. We know this from Germany: it is not even necessary to count among

the absolute top earners in order to have to surrender nearly half of one's income to the tax

authorities. Basically, it is a scandal — one about which there is no longer any

open discussion. In Dubai, for example, there is no income tax at all. In the United

States, the state burdens its citizens with around 27 percent. Anyone who can calculate,

who is well educated and mobile, draws the consequences. Alongside the tax burden, social

crises increasingly come into play: uncontrolled migration, the decay of major cities, and the

visibly hostile climate of ever-expanding bureaucracies. For many ambitious people, life in

the EU's Europe is simply too expensive, and the essence of bureaucracy too overbearing.

Another

Tax Revolt May Be Right Around the Corner. Anyone old enough to have lived through

the mayhem and economic decline of the 1970s probably will recall the tax cut heard round the

world. That was the famous California ballot initiative Proposition 13, which slashed

property taxes by more than 25% and then screwed a tight cap on future rate increases.

[Advertisement] This was the tax cut that saved California, helping ignite the go-go days of

Silicon Valley and build what are now trillion-dollar companies. This was also the dawn of

the Reagan era of lower tax rates, the conquering of runaway inflation, and skepticism of big

government at the state and local level. Once Prop 13 passed in California, a dozen more

states slashed out-of-control property tax levies that were driving older Americans out of their

homes. Selling the house to pay the taxes was a routine occurrence. Now even CNN

reports another "property tax revolt is spreading." Why? Because nationwide, property

tax collections went up nearly 7% last year, easily outstripping inflation.

To

understand the property tax revolt, you need to understand property taxes. Well, here

we go again. CNN tells us that a property tax revolt is spreading, with a nationwide movement

to eliminate property taxes on the march. Most of us are familiar with the basic scenario of

property taxation. Every state is replete with numerous political subdivisions commonly known

as "municipal corporations." These are counties, cities, school districts, fire districts,

water districts, sewer districts, diking distraction, etc., etc. Each of these is known as a

"taxing district" because state statute authorizes these districts' legislative authority to adopt

an annual budget and levy that budget as a tax on the property owners in the district.

The

capital gains tax on home sales has got to go. With a reform in this area, economic

activity would expand geometrically. Substantial increases would occur in the businesses of

and employment by real estate brokers and sales agents, contractors and subcontractors, moving

companies, furniture and interior design companies, architects and engineers, and mortgage

lenders. Encouragement of just one sale could, and probably would, significantly increase

many downstream transactions and actually generate significant income tax increases paid by real

estate brokers, contractors, and other businesses and their employees. The trickle-down and

other benefits to the economy cannot be overstated.

Tax

Avoidance Isn't a Crime, It's a Skill — And the Big Beautiful Bill Just Made It

Easier. The American tax system wasn't built to make you rich. It was built to

keep you in line. For most people, taxes are a lifetime subscription. Work

harder. Earn more. Pay more. But every now and then, the system tosses the

average American a bone. The Big Beautiful Bill is one of those moments. This bill

isn't perfect. It's not even permanent. But it gives working Americans a rare shot at

lowering their taxes in meaningful ways. And for those willing to dig deeper, it might be the

spark that leads to a much bigger financial awakening. Let's start with the obvious.

The bill removes federal income tax on tips and overtime. That's a huge win for waiters,

bartenders, nurses, and tradespeople — people who've long been taxed to death for going

the extra mile. Sure, they'll still pay into Social Security and Medicare through FICA (which

I like to call "Funds I Cannot Access") because you pay into it for decades, then get taxed again

when you finally collect — if you live that long. But removing the federal income

tax gives working folks breathing room and maybe even a shot at saving or investing instead of just

treading water.

Perp

Walks and Jump Suits. No single feature of the RINO/Swamp enrages America more than

that blatant legal double standard we face. If we don't do our taxes just right, we get hit

with interest and penalties high enough to pay for a large tax intervention industry. But if

a Senator or Congressman makes millions while in office, no one in the IRS cares enough to wonder

why they're getting a refund on a salary under $200k. [...] But those politicians —

elected, appointed, and judicial — are all being protected. We have to pay our

traffic tickets. They don't even get tickets, and that's just not fair! Are the cops

asleep? These pictures are simply inadequate to the task. The degree of evil we see

daily coming from Mordor on the Potomac is so great that only one remedy is possible —

blindingly bright direct sunlight.

Progressive

'Exit Taxes' become the new Berlin Wall. As reported by Blackout News and then

Climate Depot, European nations like Germany, Norway, and Belgium are "spearheading new regulations

designed to tax capital gains before individuals emigrate." For context, these three nations

already have some of the highest taxation rates in the world. When you look at personal

income tax rates, Germany's top bracket is 47.5%, Norway's is 39.6%, and Belgium's is 53.5%.

(Out of 36 European nations, Germany ranks 12th highest, Norway 19th highest and Belgium fifth

highest.) And, hitting those top tax brackets isn't just for the jetset elites. In Belgium,

once your income reaches €48,320, you're in the top bracket. Converted to American

dollars, that means if you're making $56,492.36, you'd be left with $26.271.95 after paying

$30,223.41 in federal taxes. (Of course, this doesn't include all the other taxes, fines, and

fees that citizens pay.) "Taxes are what we pay to live in a civilized society" they say.

But what do places like Germany, Norway, and Belgium have to show for it?

Whenever

Illinois can burden its citizens with taxes, it will. Illinois Democrats have

supermajorities in both legislative bodies. They also control all major state offices and

both U.S. Senators. They also love to tax people. There is never enough. The

Motor Fuel Tax will continue rising. In July, it will be 48¢/ gallon, up from 19¢

in 2019, a 152% increase in six years. But the Democrats say they need more. Illinois

has the second highest MFT in the country, only behind California (also Democrat run). Democrats

say they care about the poor and middle class, but the gas tax is regressive, harming low-income

people most. Isn't it nuts to have so much reliance on taxes on gasoline when Democrats want

to outlaw its use?

Virginia

Vehicle Property Tax Is Highest in Nation. Why Are Dems Fighting So Hard to Keep

It? Virginians pay an average of $1,139 in annual property taxes just to own a

car — the highest in the nation. In the 2025 legislative session, Republicans

proposed providing car tax relief to low-income families, but Democrats killed the

bill — just as they've repeatedly killed Republican bills that would provide tax relief

for Virginians. Democrat Senate Majority Leader Scott Surovell called Gov. Glenn

Youngkin's (R) proposal for car tax relief "a zombie gimmick that got rejected in the 90s."

Democrats seem to forget the history of the issue, which heavily favors Republicans. In 1997,

Jim Gilmore (R) was elected governor on a platform of getting rid of the car tax. Gilmore was

able to get legislation passed in his first year to phase out the tax over five years. Then

came Democrat Gov. Mark Warner in 2002, who immediately froze the car tax relief at

70 percent and then further eroded the phase-out plan into what remains in place today.

Senate

DOGE leader seeks crackdown on tax-dodging government workers. As Tax Day approaches,

the Senate's DOGE leader announced a new effort Monday aimed at cracking down on federal

bureaucrats who have racked up billions in unpaid taxes. Sen. Joni Ernst, R-Iowa, is

introducing the Tax Delinquencies and Overdue Debts are Government Employees' Responsibility (Tax

DODGER) Act in response to reports of tax scofflaws within the bureaucracy the taxes themselves are

supposed to bankroll. The Tax DODGER Act would require the Internal Revenue Service (IRS) to

publish an annual report on tax delinquencies of current and retired federal employees, including

those who failed to file a 1040 or other tax return. "It is outrageous that while hardworking

Americans fork over their money to Uncle Sam, nearly 150,000 bureaucrats refuse to pay their own

taxes," Ernst told Fox News Digital.

The

fix is in to repeal Colorado's Taxpayer Bill of Rights. Back in 1992, the citizens of

Colorado passed an amendment to the state constitution to limit tax increases. They called it

the Taxpayer Bill of Rights, or TABOR. TABOR did not eliminate taxes, nor did it prohibit tax

increases. Instead, it merely limited tax increases to the rate of inflation plus the

population growth of the state. Even those limits can be exceeded by a mere majority of the

voters of the jurisdiction seeking to exceed it. If the voters of Colorado want to raise the

state income tax rate, for example, they can do so with a simple majority vote in the next

election. Likewise, if the citizens of a municipality want to raise the city sales tax, they

can do so by a simple majority vote in the next election. The people of Colorado love TABOR.

[...] But the Democrat establishment hates TABOR, and it's not just because it has the dreaded

"Bill of Rights" phrase in its name. They hate it because it accomplishes its

objective — it limits tax increases that are not approved by the citizens being

taxed. Democrats want taxes to go up far faster than inflation and population growth, and

they want it to happen without the OK of the voters.

Mississippi

Abolishes State Income Tax in Historic Win for Working Families and Economic Freedom.

Mississippi has officially abolished its state income tax, positioning itself as a leader in the

movement for economic freedom and limited government. Republican Governor Tate Reeves signed

the legislation into law Friday, declaring it a "generational victory" and a bold new chapter for

working families, entrepreneurs, and freedom-loving Americans across the South. "We did it,

Mississippi!" Reeves wrote in a triumphant post on X. "We just eliminated the income

tax!" While Washington continues to suffocate the American people with taxes, inflation, and

runaway spending, Mississippi is doing the opposite — returning power and prosperity to

its citizens.

Taxation

as a Moral Question. The problem with the Caesar Schumers of this world is that they

hold the power to assert unilaterally what is "due" them — and that price is what more

and more Americans are pressing back against. The moral question of taxation needs to start

with not "How much can the state take?," but "Why is the state justified in taking this?"

There's a right claim at stake here, and "Thou shalt not steal" has no governmental

exception. The second issue, closely allied to the first, is whether the costs these taxes

are supposed to pay are happening at the proper level of responsibility. The erosion of

federalism has transferred more and more tasks to Washington, whose remoteness makes oversight

harder. Before we hand out Department of Education grants to local schools, we need to

ask: Why is this coming from Washington rather than New Jersey or Texas or Idaho?

Before we send $47,000 to Colombia for a "transgender opera," we need to ask: why should the

government be paying for any opera, foreign or domestic?

We

Should All Be Much Much Richer. Every Single One. I don't know whether you

caught Howard Lutnik, Trump's Commerce Secretary on CBS Thursday, but it thrilled Absurdistan to

bits. Trump's plan, he says, is to eliminate income tax on those making less than $150,000.

To me, that and regulatory reform accompanied by cutting the admin state by 30%, will change not

just the States but the entire world. I see towns and counties across America lit with sun

and life. The energy and creativity that will unleash, the happy family formation, the

independence of people, will soar. With that, engaged citizens will reform their own

politics, slipped of the iron ring of servitude to the state most of us experience. Seeing

that wealth created, every politician in every country will have to follow.

The Editor says...

Not everyone should be wealthy. Those who are too lazy to work

should starve

.

This

State Is Ready to Abolish Property Taxes. I hesitate to write about anything that is going

to encourage people to move to the Southeast. As we like to say here in Atlanta, "we full."

But it's not just that. Yankees and West Coasters love to move to our little slice of the country

because we have a cheaper cost of living and bring their liberal big government and high-tax policies with

them, and it kind of ruins things for the rest of us. Well, I'm going to make an exception here

because I like what's happening in Florida, and I hope my home state of Georgia — and the

rest of the country — follows suit. The state wants to abolish property taxes, and

Gov. Ron DeSantis (R-Fla.) is behind the idea 100%.

Art

Of The Deal: Trading The Income Tax For Tariffs. While speaking Saturday in Las

Vegas, President Donald Trump suggested, as he had during the 2024 campaign, replacing the federal

income tax with tariffs on foreign imports. We don't need to see an economic analysis to

believe this is debate worth having. Of all the good Trump could do as president in the next

four years, eliminating the federal income tax would be one of his greatest achievements. "If

the tariffs work out like I think, a thing like that could happen, if you want to know the truth,"

he said. Trump also reminded the fussbudgets and change-fearing conventionalists who will

predict that without a federal income tax the country will fall into a decline that until the 16th

Amendment was ratified in 1913, there was no federal income tax. That's right, establishing a

federal income tax required a change to the Constitution. The Supreme Court in 1895 struck

down an effort in the year before to establish a national income tax. It was, said five

justices, unconstitutional. An income tax at any level is insidious.

Why

Property Tax Is Illegal. [Scroll down] If property valuation were true,

requiring a willing buyer and willing seller neither under duress, and cash settled, then the

maximum value assigned could only be what the house was built for or what the house was purchased

for, until such time as the house is sold. The laws and violations thereof have morphed to

the point where the cash grab of the local Taxing Entities (i.e. School Districts) have

rendered meaningless all the protections in law that were established to protect the Citizen real

estate taxpayers, and this has an extreme fraudulent inflation factor. There are 8 elements

of real estate tax in the milk that goes in your cappuccino. Therefore real estate tax fraud

on a mass scale effects every person who shops whether they realize it or not. The more

elements of tax, the higher the inflation, the higher the fraud. If those protections are

going to be ignored (USPAP, State Property Tax Code, State Constitutions and U.S. Constitution),

then the net result is the equity stripping of property taxpayers, such that if there is no law,

then why pay real estate taxes. In other words, either the law exists, or it doesn't.

When a private company does this, they call it price gouging.

MTA

could hike NYC congestion toll by 25% on 'gridlock alert' days in 'surge pricing'-style tax

squeeze. The new $9 toll to drive into Midtown Manhattan could soar another

25% — to $11.25 — on "gridlock alert days" starting next year, The [New

York] Post has learned. The MTA's right to jack up the already hotly controversial commuter

tax was listed in a footnote in the revised congestion pricing plan filed with the state's

rule-making publication, the New York State Register. "If whacking hardworking Jersey and New

York families with a new, $9 a day Congestion Tax wasn't enough, the MTA is now pouring extra salt

on the wound with a 25 percent extra Uber-style surge pricing tax on so-called 'Gridlock Alert

Days' — whenever they want," seethed Dem Rep. Josh Gottheimer, who represents

northern New Jersey communities that border the George Washington Bridge into Manhattan.

California

businesses shocked by payroll tax hikes from $55B unemployment fraud. Many California

business owners are shocked by payroll tax increases incurred by the state's $55 billion

COVID-19 pandemic-era unemployment and payroll benefits fraud — which is more than

NASA's annual budget — incurred from automatically approving applications. States

that do not pay off unemployment benefit loans from the federal government, as California and a

handful of other states have done since the pandemic, automatically are subject to rapidly

increasing federal payroll tax increases until the debt is paid off. Chef Andrew Gruel, who

owns and runs Calico Fish House in Huntington Beach, took to X to explain his recent experience

paying his workers in a post that has since garnered over 16 million views. "We just ran

payroll. The payroll taxes were 2K higher than calculated. We called the payroll

company," said Gruel. "They explained (in summary) that California has a budget shortfall, and the

federal government wants money back that it lent California for UI that it 'lost.' They are

making up for it by having business owners pay it."

The

Blind Eye. [Scroll down] We are also aware of the untruth buried in

Kamala's financial plans. Another of the Commandments tells us not to steal, but what do you

call a 25% tax on "unrealized gains?" Did the DNC think we can't do math? If you own a

million-dollar house and its value goes up to $1,200,000 then, whether you sell it or not, you owe

$50,000. That's theft. Hasn't rampant inflation robbed us enough? Aren't taxes already

too high? And we know that old canard about making the rich pay "their fair share" is just

hogwash. We know that:

The "rich" already pay 95% of the tax burden.

The corporations merely pass the tax bill on to the consumer.

Printing more money merely taxes all of us.

Kamala evidently thought she could slip all that past us and ramp up the theft already being perpetrated.

Exposing

the Lies About Georgia's Ballot Questions. [Scroll down] The way tax

policy in Georgia works now is that if you have any questions or issues with your taxes, you deal

directly with the Department of Revenue. I'm sure there are many wonderful people at the DoR,

but we don't elect them, despite what the Dems want you to think. They're unelected

bureaucrats whose interest is to make sure you give them money. The Tax Court would take the

issue of tax questions out of the hands of bureaucrats and place it in front of an impartial

judiciary. And taxpayers can represent themselves in front of the court.

Mayor:

Get a Reverse Mortgage to Pay Your Taxes. In a city that has raised taxes by almost

25% over the past half-decade, the mayor has made the obvious suggestion: use your home's equity to

hand over your wealth to keep the city's gravy train going. [Advertisement] You will own

nothing and be happy. [Tweet with video clip] It's a brilliant solution if you

think about it. You worked all your life to buy your house outright, happy that you can pass

along the value to the next generation. But really, wouldn't you rather keep the government

bureaucrats happy instead? The children of the community are the children of the community,

which means that your children belong to the government, just as your home should too.

The

Tax Reform Debate. [Scroll down] For instance, implementing a flat tax

rate of 15 to 20% across all income brackets, as advocated by Senator Ted Cruz's "Simple Flat Tax"

plan, can simplify compliance and boost competitiveness. Additionally, adopting a

"territorial tax system," similar to the one implemented in the 2017 Tax Cuts and Jobs Act, can

encourage domestic investment by exempting foreign-earned income from taxation. Furthermore,

conservatives can push for the elimination of the Alternative Minimum Tax (AMT) and the Death Tax,

which disproportionately affect small businesses and family-owned enterprises. By also

increasing the standard deduction to $12,000 for individuals and $24,000 for joint filers,

conservatives can reduce the number of taxpayers subject to complex itemized deductions.

A

Note to the Temporary Oppressors. Politics are just another scam, a means of wresting

the last few coins from people's pockets. Nowhere, in this modern nation is the ability of

the individual to protest the evil of government by denying sustenance to it. Before income

tax, property tax, sales tax and special taxes on gasoline and tobacco, the people had a much

greater ability to refuse to participate in government boondoggles that generally had to be funded

by bonds sold to the people. If you didn't believe that a road or bridge would benefit you,

you could simply refuse to purchase a bond. War bonds are a good example of the government's

need to ask us for further assistance. This is how a great deal of civic projects should be

funded. Let those who seek to spend more to get more do so and those who do not support the

project keep their change in their pockets.

Trump

Proposes Eliminating Taxes On Overtime Pay For Workers. Former President Donald Trump

proposed Thursday during a campaign rally in Tucson, Arizona, to eliminate taxes on overtime pay

should he win the election this November. Trump called for eliminating taxes on overtime

wages for workers who work more than 40 hours a week. The former president said removing

such taxes would bolster worker incentives and simplify recruitment for businesses.

Chicago

Democrats wield the taxation sledgehammer and smash the low-income black communities.

So much for the schtick that progressive tax policies won't impact anyone struggling to survive in

this economy! According to a piece out at Crain's Chicago Business, Cook County Democrats

recently hiked property taxes across the board, with increases larger than any other in nearly

three decades. Of course, on the southside of Chicago, the hardest hit were the low-income

blacks. [...] A person making $24,500 per year, living in an inherited home, could easily be taxed

into poverty, and forced to sell a property they own outright, because they can't afford the tax

bills; progressive politicians are taxing people out of their own homes, and as always, the

hardest hit are those on the lower rungs of the socio-economic ladder.

Goodbye,

JFK Democrats. President John F. Kennedy was a staunch anti-communist who fought

against union and government corruption. He was a pro-life Catholic. He was

laser-focused on faster growth ("we can do bettah") and saw sweeping tax rate reductions as a step

toward achieving 4% to 5% growth. Democrats are now for higher taxes: They ignore and

excuse union and government corruption and they don't even talk about growth. It is all

income redistribution. They should listen to the words of wisdom of JFK circa 1960 to 1963.

In 1962, he famously declared: "It is a paradoxical truth that tax rates are too high and tax

revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates

now." Sadly, today you could count on one hand the number of Democrats in Washington who

believe that. JFK called for a reduction in income tax and capital gains taxes. Kamala

Harris wants to raise every one of these rates — including doubling capital gains taxes.

Harris

Agenda: Taxes on Gains That Don't Yet Exist. Kamala Harris's handlers want her

to win with joy, not substance. Her job is to travel around joyfully with Tim Walz to fire up

the crowds, not with an agenda but with some ethereal version of hope and change. Substance

and truth are missing, and in their place is joy and lots of misinformation, disinformation,

outright lies, bald-faced lies, and lies by omission, backed up by fully corporatized media.

Harris won't tell us what her agenda is; she refuses to answer serious questions, and it's not as

if a serious reporter could get close to her. It's the basement campaign that Biden

ran. Some people doubt she will tax unrealized gains — gains that do not

exist — gains on any appreciating assets — but she will. She has made

herself clear in the recent past. Harris will claim it will only be levied against the

wealthy. However, no one should lose their rights because they are in a certain tax

bracket. Anyway, they'll take their wealth and leave. Additionally, once this communist

value is in our government, it will grow like a fast-spreading cancer as greed sets in.

Report:

Kamala Harris Wants to Hike Taxes by $5 Trillion. Democrat presidential nominee

Vice President Kamala Harris's economic plan would increase taxes by $5 trillion over ten

years, according to Americans for Tax Reform (ATR). Harris's campaign announced an enormous

economic package on Monday that would undo former President Donald Trump's tax cuts, claiming it

would be part of "a fiscally responsible way to put money back in the pockets of working people and

ensure billionaires and big corporations pay their fair share."

The

Property Tax Scam. Like pandemics and climate change, inflation is a handy

smokescreen for government overreach. The modus operandi of this deception is the doctrine

that "inflated property values inflate property taxes." While that has a plausible ring to it, the

property tax system in most states is actually invulnerable to inflation. If, at the stroke

of midnight, inflation caused the assessed value of all taxable property to double, no one's

property taxes would increase. Incredible? Allow me to explain. [...]

The

Disaster Lottery. The governments take our taxes, largely willingly offered in a lot

of cases, but will rip it from one's very hands if necessary. That is a flaw of the system in

itself, because it allows for no political leverage. The opposing party is supposed to use

leverage of the purse to satisfy their constituents, but long ago they had found that they could

all do much more if neither side hindered spending. If one wants to look at the overall trend

since 1787, they will find an increasing and intentional sapping of political leverage the people

might exert against the irrational and self-serving interests of politicians. They just take

the money and do with it whatever they will, relying on some future election to sort itself out as

to whether it was an egregious enough theft to warrant a replacement.

The

Looming Kamala Calamity. Just a few of the taxpayer disasters that Harris has in mind

are that health care is a fundamental right and "Medicare for All" should be the policy. She

also believes in economic security for all who are unable or unwilling to work. She favors

family and medical leave, vacations, and retirement security for all workers, as well as

"high-quality health care" administered by the federal government. [...] She is a nightmare on

taxes. As if we are all not forking over enough money already, Harris has pushed to raise the

corporate income tax, expand the estate tax, impose a financial transaction tax on stock trades,

raise the top marginal income tax rate on the top 1% to 39.6%, and implement a 4% "income-based

premium" on households making more than $100,000 annually to pay for her "Medicare for All" gambit.

En

Banc Fifth Circuit Strikes Down FCC's Universal-Service Tax as Unconstitutional Delegation.

In a ruling today in Consumers' Research v. FCC, the en banc Fifth Circuit ruled by a

vote of 9 to 7 that the multi-billion dollar Universal Service Fund tax levied by the Federal Communications

Commission rests on an unconstitutional combination of delegations and subdelegations of Congress's

legislative power. Judge Andrew Oldham wrote the majority opinion for nine judges. Judge

Jennifer Elrod and Judge James Ho each wrote short concurring opinions. Judge Carl Stewart wrote

the principal dissent for all seven dissenters. Judge Stephen Higginson also wrote a dissent.

France

[is] 'on the brink of financial meltdown' as 'rich to flee country over 90 percent tax'.

France is on the verge of a "financial crisis" and consequent economic decline after the surprise

success of a hard left coalition in this weekend's elections, the country's outgoing finance minister

Bruno Le Maire has warned. Speaking on the political situation, UK-based banking expert Bob

Lyddon has told Express.co.uk the result signals an end to Emmanuel Macron's policy of "controlling debt

and public spending", warning the inevitable "deadlock" is no better than a victory for Marine Le Pen's

far-right National Rally. In a possible hint at future chaos, riot police clashed with left-wing

demonstrators in Paris on Sunday evening.

New

electric vehicle fee coming to Pennsylvania. Come 2025, electric vehicle drivers will

pay an annual registration fee in Pennsylvania. The legislation headed to Gov. Josh

Shapiro's desk will charge owners of battery-powered and plug-in hybrid vehicles $200 next year,

the first of an incremental scale that will reach $286 in 2030. Prime sponsor Sen. Greg

Rothman, R-Shippensburg, said the fee will help maintain Pennsylvania's roads and bridges —

some of the worst-rated in the nation — and shift some of the burden off the state's gas tax.

The Editor says...

If the state and federal governments would stop wasting money,

they would have plenty of tax revenue.

West

Virginia beats tax collection estimates by $827M. West Virginia announced it beat

revenue estimates by nearly $827 million for the fiscal year, meaning the state will now

implement a 3% or 4% personal income tax cut. The tax cut is part is an automatic trigger

from House Bill 2526, signed into law in 2023. "When I first took office, I promised you all a

rocket ship ride, and look at us now," Justice said. "We've cut over a billion dollars in taxes,

and it's truly unbelievable. This is exactly what a responsible government should do for its

people, especially in a state like ours. When the state does well, the people do well."

The Editor says...

I suppose repealing the income tax wasn't even considered.

Joe

Biden Thinks He Can Tax Gains in the Value of Your House When You Have Not Yet Sold

It. This week the Supreme Court decided its biggest tax case of the last generation,

Moore v. United States, so narrowly that it wrote a ticket that is good for the Moores'

train only and not for almost any future trains. The big news that I glean from reading the

opinions in Moore v. United States is that both Biden Supreme Court appointee, Justice

Ketanji Brown Jackson and Joe Biden himself, though his Justice Department, think that Congress has

limitless power to tax unrealized capital gains or to enact a wealth tax on your net worth.

Justice Jackson concluded her opinion by saying essentially that all questions concerning the Tax

Clause of Article I, Section 8 or the scope of the 16th Amendment are political questions

that are not reviewable by the federal courts. This means that the government could tax

increases in the value of your house or apartment; in your IRA retirement savings account; or in

any other stocks that you happen to own even without you selling any of those items.

'No

Tax On Tips' Reveals the Chasm Between Left and Right. President Trump has focused

his 2024 campaign on a number of issues that one would expect, but he shook up the game this summer

by issuing a new policy proposal: "No Tax On Tips." [...] The Committee for a Responsible Federal

Budget declared that this program would likely cost the federal government between $150 and

$250 billion in revenues over ten years. The Democrats consider this terribly

irresponsible. But they happily spend that much in weaponry for a war between Russia and

Ukraine, or for hotels, food, education, transportation and hospital bills for illegal

aliens. At least President Trump's proposal is for American workers. And when you

re-read that number, you see that the estimate is over ten years. That means the accountants

are estimating a cost to the federal government averaging $15 to $25 billion per year, in a

nation with a federal government currently running a $2 trillion deficit on a

$6.5 trillion annual budget. Viewed in that context, to describe President Trump's

proposal as being a drop in the bucket — a veritable rounding error — would

hardly be an exaggeration.

FairTax

101: Making America Great Again. President Trump recently floated the idea of

eliminating the federal income tax. That tax became a fixture in 1913 when Congress ratified

the 16th Amendment. The first U.S. Tax Code was about 400 pages. Today, with everything

included, it's more than 70,000 pages! Initially, the income tax was 1% on all incomes above

$3,000 ($95,000 in today's dollars) and applied to only 3% of the population. Today, the

graduated rates start at 10% for families earning more than $30,000 and go up to 37% for families

earning above $609,000. The rates vary greatly: The top 1% of taxpayers pay 45% of all income

taxes, the top 25% pay 89%, and the bottom 47% pay 0%. Trump understands that the tax system

is a yoke on the neck of American prosperity. According to the National Taxpayer's Union,

Americans spend approximately $260 billion a year complying with the federal Tax Code, most of

which goes into the pockets of accountants and lawyers. And that doesn't count the countless

billions businesses spend adjusting their operations to reduce their tax burden in the first place.

Westbrook

Voters Reject School Budget with Nearly 16 Percent Property Tax Hike. Westbrook

residents voted Tuesday to reject the town's proposed $51.7 million school budget that

included a nearly 16 percent increase in the school property tax rate. According to the

Portland Press Herald, this was reportedly the first time that Westbrook voters have ever rejected

a school budget at the ballot box. The proposal was voted down by a margin of just 53 votes,

or by about 2.78 percent. In total, 48.38 percent of Westbrook voters supported the

school budget, while 51.16 percent opposed it.

Conscientious

Objector to Taxes. If one can be a conscientious objector to military service and be

given a role that, without relieving one of the duty of service, does not require one to pull a

trigger and kill another human being, so should taxpayers be able to pay taxes without being forced

to fund illegal activity. I know this subject has come up before and was summarily executed

by the courts, we are in an entirely different world today. On the one hand the government is

so thoroughly corrupt and in the hands of lunatics that its implosion from lack of fiduciary

responsibility, morality or common sense is likely to encourage its own demise in weeks or months

and provide for a citizen's reset during which all manner of corrections might be made to the

system. On the other hand, it has been so for quite a while now and seems to have some

levitating capability over the abyss that just might last another decade during which the people

will lose all ability to correct the system without either civil war or counter-revolution.

And

the taxpayers all went out of Massachusetts. Let's add another state to the list of

blues losing people and taxpayers. It's Massachusetts, or one of the original 13, but another

one bites the dust, proving the reality that going blue has consequences. [...] According to the

story, people are leaving because of three reasons: a high tax burden, expensive housing, and

health care costs. There goes Obamacare again! Another reality is that remote work

policies have made it easier for "prime age" workers to leave. Why does that matter?

Prime age workers buy homes and cars, and pay taxes.

Why

does America give billion-dollar tax credits to illegal immigrants? This election

year, illegal immigration has jumped to the very top of the list of voters' most important

issues. If you watch the news, you might not be surprised by that — because of

chaos at the border, record-breaking numbers of border crossings under Joe Biden, and high-profile

crimes committed by people who shouldn't be here in the first place. Every year, billions of

dollars are taken out of your tax returns and put into the pockets of illegal aliens in the form of

child tax credits. If you just spent an April night at your kitchen table, making sure you

follow the letter of the law to do your duty as an American taxpayer, that's not a comforting

thought. And it matters more than just for today. That tax credit affects the number on

the bottom of your tax form today — because taxpayers, every single one of us, are

paying for it — and it matters to tomorrow's taxpayers who are going to be on the hook

for a whole lot more.

Biden

Does not Understand Taxes. Biden is again on a tax-raising rampage. He proposes

to increase income taxes by nearly $5 trillion for corporations. Increasing the

corporate income tax rate to 28% (from 21%) will be a great driver of negative effects on the U.S.

economy, reducing long-run GDP by 0.9%, the capital stock by 1.7%, wages by 0.8%, and full-time

jobs by 192,000. Additionally, Biden's new tax proposals include increasing the recently

enacted corporate alternative minimum tax rate from 15% to 21% and denying business deductions for

employee compensation above $1 million. Biden proposes an increase of the corporate

income tax that's a higher tax rate than in communist China, France, and the U.K., each at 25%.

Add to that rate the average state corporate income tax of 4% and the average combined rate will

be 32%, the second-highest corporate income tax rate (just below Colombia) in the developed

world. As the late, great Paul Harvey used to say, "Corporations don't pay taxes."

Households bear the burden of corporate income tax increases in the form of higher prices and/or

slower wage growth.

California's

New Electricity-Income Tax Is Only Weeks Away. In a couple of weeks, California's

Public Utilities Commission will vote on whether or not to adopt a new fixed charge for

electricity, one that will likely be based on income. When I first wrote about this proposal

a year ago, the utilities were suggesting that fee could be as high as $85 a month for some

households. That's not including whatever the utilities charge for actual usage of

electricity. The new fixed fee as proposed was essentially an income tax being paid via your

electric bill. Since then, the proposal has been scaled back quite a bit but some version of

it now seems likely to pass.

Greedy

hand of government goes wild in Massachusetts: 'Basically, we're going after everyone who has

money'. [Scroll down] Sound like the kind of state you'd like to live

in? A lot of people in Massachusetts don't think so. They're fleeing "in droves,"

as the Boston Globe put it, in one of the highest blue-exodus states in the country. [...] Working age

people with education are the ones who want out, the actual taxpayers. The actual loss in the

last year is in the neighborhood of 300,000 and 400,000 people (all of their numbers are

divvied up by demographics, so some could overlap), with net "international" migration (read:

illegals) making up for about 50,000 of the losses, according to their charts.

Some

Crude but Worthwhile Tax Solutions. [Scroll down] I would like to offer

three solutions — none of which will be enacted, and such is the pity of the world we

know. [...] [#1] Single-family, owner-occupied primary residence shall be wholly exempted from all

property taxes. [...] [#2] All profits derived directly from the sale or barter of items produced,

harvested, or manufactured in a single-family, owner-occupied cottage industry or family-run farm,

when sold or traded directly to the end user or consumer by the one having produced, harvested, or

manufactured such items, shall be exempt from all taxes. [...] [#3] It shall be unlawful to charge

more than 1% simple interest per annum on a loan given to purchase a single-family, owner-occupied,

primary residence. It shall be unlawful to charge more than 1% the total value of said loan

for any and all closing costs. It shall be unlawful to enact any penalty or fee on the

prepayment or early payment of such a loan. [...] These three things would solve, address, or

otherwise mitigate so many "issues" (symptoms) facing our country today. It would in one

year's time become an entirely different world — the one intended by the men who

imagined it.

Let's

Curb-Stomp the IRS. [Scroll down] Deroy Murdock proposed his 0-10-100 plan

back in 2015, and it retains the charm of its simplicity. 100% of adults and corporations would pay

10% on everything from wages to tips to gifts to earnings to capital gains and would get zero

deductions. Nope, not a single deduction, or mission creep would inevitably kick in.

Politically, Murdock's plan might have the best chance, since each side would have to give up

something dear. But it would still require an intrusive tax agency of some kind, which makes

it less appealing to me. More appealing is the Fair Tax, which would eliminate payroll taxes

and individual and corporate income taxes. Washington would be funded instead by a national

sales tax — partly offset by a monthly "prebate" paid to every household. As

described by Americans for Fair Taxation, the prebate is "an 'advance refund' at the beginning of

each month so that purchases made up to the poverty level are tax-free." You would take home

100 percent of your pay and determine your tax rate by how much you spend.

Black

Democrat Congresswoman Suggests Blacks Shouldn't Pay Taxes. Democrat congresswoman

Jasmine Crockett suggests black people shouldn't pay taxes but then admits it's a dumb idea because

they "aren't really paying taxes in the first place." The comments came during an interview on

the "The Black Lawyers Podcast." "One of the things they propose is black folk not have to pay taxes

for a certain amount of time because... that puts money back in your pocket." [Video clip]

Democrat

Rep. Jasmine Crockett: Black Americans Should [Be Exempt From] Taxes as a Form of Reparations.

Freshman Rep. Jasmine Crockett (D-TX) suggested that black Americans should be exempt from paying

taxes as a form of reparations but then said it might not work because of the black people who are "not

paying taxes in the first place." Crockett, who recently made headlines for perpetuating the

debunked myth that U.S. border patrol officers "whipped" Haitian migrants, was giving an interview

on "The Black Lawyers Podcast" when she brought up the idea.

New

Jersey, feds to duke it out in court over $15 congestion pricing toll as Garden State tries to

block fee. The hotly contested issue of whether New York's $15 congestion toll should

go forward is hitting a federal courtroom this week as New Jersey seeks to block the measure.

Garden State lawyers will face off against attorneys for the US Department of Transportation, the

Federal Highway Administration and the MTA Wednesday and Thursday in a Newark courtroom over

whether a sufficient review was conducted to assess the impact of the toll on Jersey drivers.

If the feds win their bid to have the lawsuit tossed out, the new fee will be one step closer to

becoming reality, despite a handful of other litigation.

30%

of NYC Property Taxes Are Unpaid with No Consequences. Since the pandemic, more New

Yorkers stopped paying their property taxes. It's attributed to the end of the tax-lien sales

program that would go into effect when people didn't pay their taxes. The notoriously

incompetent City Council didn't renew it. Under that plan, the city was authorized to sell

liens on single-family homes and condos after three years of nonpayment; liens on other property

types could be sold after one year. They don't have to and don't seem to care, or they can't

because New York is bad for business. Inflation and regulations are not mentioned but must be

part of the problem. Bloomberg mentions that mandatory regulated rents make it hard for

landlords to collect rents. Overdue property taxes are forecast to reach their highest level

ever, jumping by over 30% to more than $880 million at the end of the fiscal year in June from

three years ago. That means New York will bring in less tax revenue since nearly half comes

from property tax collections.

Increasing

cigarette taxes doesn't make sense. While there are many good reforms currently under

consideration in the Legislature, Nebraskans are right to reject higher sales taxes. The

cigarette tax increase is especially egregious. Not only would the tax hike disproportionately

harm lower-income Nebraskans (who are more likely to purchase cigarettes), it's also fiscally unwise.

Dramatically raising cigarette taxes will incentivize folks to either buy cigarettes that have been

smuggled in or cross the state border themselves to purchase them. As such, it fails to provide

a good revenue substitute for property taxes, which are less easily evaded.

MTA

chief says $15 congestion pricing is coming to NYC no matter what. MTA chief Janno

Lieber said Friday that like it or not, congestion pricing is happening — as about 100

New York City firefighters and scores of other foes showed up at a public hearing in Manhattan to

protest it. While the hearing was the transit agency's second in two days to supposedly

listen to the public over the proposed back-breaking new $15 Midtown toll, Lieber told reporters

during a break that any attempts to halt the plan are DOA at this point. "This is frequently

represented like I went on a drinking binge and came up with this idea in funding the MTA,'' the

agency's chairman and CEO griped of the Metropolitan Transportation Authority's hotly controversial

plan targeting drivers traveling south of 60th Street in Manhattan.

IRS

Official Tells O'Keefe Media Group Reporter That the IRS uses AI to Spy on Americans' Bank

Accounts. O'Keefe Media Group has infiltrated the IRS! According to Alex Mena,

an IRS official with the criminal investigations unit in New York, who met with O'Keefe Media

Group's undercover journalist, the IRS uses artificial intelligence technology to spy on American

citizens and company bank accounts without a warrant or evidence to uncover what they consider

fraud. According to the source, the IRS is "going after the small people" and "destroying

people's lives." All of the agents are "like robots," said Mena. This is quite ironic,

as The Gateway Pundit recently reported that O'Keefe Media Group exposed the No Mas Muertes (No

More Deaths) organization, a nonprofit and ministry of the Unitarian Universalist Church of Tucson,

for smuggling illegal immigrants from the border in Arizona. This 501(c)(3) organization

holds a tax-exempt status for hundreds of thousands of dollars in donations, but the IRS is

targeting innocent Americans!

New

Testimony Reveals an IRS Contractor Stole Much More Than Trump's Tax Returns. In

2019, then IRS contractor Charles Littlejohn stole President Donald Trump's tax returns and

illegally leaked them to the media. They were also given to Democratic operatives. Last

month, Littlejohn was sentenced to five years in prison after pleading guilty to a number of

federal crimes. "Littlejohn accessed tax returns associated with Public Official A (and

related individuals and entities) on an IRS database after using broad search parameters designed

to conceal the true purpose of his queries. He then uploaded the tax returns to a private

website in order to avoid IRS protocols established to detect and prevent large downloads or

uploads from IRS devices or systems. Littlejohn then saved the tax returns to multiple

personal storage devices, including an iPod, before contacting News Organization 1," the Department

of Justice details.

Hawaii

looking 'to introduce a climate change fee for visitors'. Visitors to Hawaii may be

hit with a new fee, following in the footsteps of other popular holiday locations around the

world. Tourists heading to Hawaii may be slapped with additional entry costs, as the popular

holiday destination looks to introduce a climate change fee for visitors. The new tax,

according to the state's Governor, Josh Green, would be introduced as a way to protect beaches and

prevent future wildfires. Mr Green estimates the flat-fee of around $25, which would be

charged at hotel check-in or vacation rentals such as holiday homes, and amount to more than $68m

annually if passed.

Federal

Entitlements and the End of the American Idea. "Collectivism" and "entitlements" are

synonyms if you break the understanding of those words down to brass tacks. Both could be

described as a governmentally-enforced societal responsibility for citizens to provide resources to

the government, in order for the government to redistribute the confiscated resources to those whom

the government has determined "need" those resources more than the citizens from whom the resources

were confiscated. The power to discriminately confiscate wealth from individual citizens in

order to provide for other citizens was, quite purposefully, not enumerated in the Constitution as

a power of government. As such, the Founders likely never imagined that it could be

done. More than any other moment in American history, the Sixteenth Amendment opened the door

to America's path to collectivism.

Bill

requiring residents to register, pay for pets is likely dead. A bill that would have

required Colorado residents to pay an annual pet registration fee, or face steep penalties for not

doing so is dead, according to its sponsor. Under the legislation, registering every pet,

including fish, would have cost residents $8.50 per animal a year. House Bill 1163 would have

required the Department of Agriculture to develop, implement, and maintain an online pet

registration system. In Colorado, with upwards of 60% of households owning a pet, many of

them with multiple animals, the cost can increase quickly.

House

Republicans Agree To Help Democrats Grow The Welfare State And Shrink The Workforce.

The legislation increases the portion of the subsidy considered refundable — that is,

the amount that households can receive as a cash payment over and above any income tax liability

they have. Under current law, $1,600 of the $2,000 subsidy is refundable, but the legislation

would increase that threshold to the full $2,000 in 2025. While this provision, along with the

others discussed below, will technically expire in 2025, Democrats will likely move to extend all

of them as part of consideration of the Trump tax plan, major portions of which will also expire

next year. While Congress calls this particular program the "child tax credit," the term in

many respects constitutes a misnomer, because most of the payments go to individuals who owe no

income taxes. For instance, the Joint Committee on Taxation found that over

91 percent — or $30.6 billion of the $33.5 billion cost — of

these changes to the "child tax credit" would come via outlay (i.e., spending) effects, making it

much more of a welfare subsidy than a reduction in tax liability.

Don't

believe your lying bank register, inflation is all but gone. The IRS has increased

late payment penalties by 167% over the last two years; the IRS does not borrow funds, and it is

not charged an interest expense, so whatever it charges for interest is arbitrary and essentially a

100% gross margin whether it is 3% or 8%. This high rate really harms those who make

less. As far as I can tell, Biden has never suggested that the government reduce any of its

taxes or fees. Why not, if he wants to help the people? As for wages: why do they

compare gross wages to inflation instead of net wages? People have to pay 100% of the cost of

goods, yet only take home an estimated 65% to 75% of their gross pay — and taxes still

have not been reduced. That is why they come up short each month.

The

Supreme Court Case That Could Upend Parts of the Tax Code. The Supreme Court on Dec.

5 will take up an important but little-noticed case about "unrealized" income that considers the

constitutional limitations on federal taxing power. The case is significant because the court

could use it to strike down the Mandatory Repatriation Tax (MRT), also known as the Section 965

transition tax, which was part of the Tax Cuts and Jobs Act approved by the Republican-controlled

Congress in 2017 and signed into law by then-President Donald Trump. Conservative

constitutionalists say if the Supreme Court finds that the MRT violates the 16th Amendment to the

Constitution, such a legal precedent could prevent Congress from enacting legislation to tax wealth.

Meet

the New Dark Age. [Scroll down] Taxation remains a focal point.

Regular folks would be much more prosperous and thus live better lives if the metastasizing Dark

Age government wasn't using its power to confiscate so much of their money. As a lad I

remember when California raised its sales tax from 3% to 4%. There were squeals of pain

everywhere. Today the state minimum is 7.25%... plus local add-ons. "Oh, you've got to

account for inflation" would be the justification. Ahem... sales tax is immune to inflation;

it's a percentage of something's price. If the price goes up because of inflation, the tax

goes up directly. Across the American landscape we have states that have either sales tax or

income tax. California is in the minority in that it has both.

AOC's

call for higher taxes on New York's 'top 5%' would hit households earning more than $250K, analysis

shows. Rep. Alexandria Ocasio-Cortez's recent call to raise taxes on New York's

highest-earning 5 percent would hit households making $250,000 or more, according to a new

analysis. The firebrand Democrat signed on to a statement issued last month by the New York

City Democratic Socialists, calling on the city and state to 'fund resources for all New Yorkers'

by raising taxes on the top 5 percent. In an analysis on Monday for the Wall Street Journal,

Tim Hoefer, the CEO of conservative think tank Empire Center for Public Policy, accused the

congresswoman of attempting to redefine the term 'rich'.

A

look back at the Philly soda tax. Want a soda? You'll pay more for one in

Philadelphia, because five years ago, local politicians decided to tax it. They're

"protecting" people, they said. The tax would "reduce obesity" and "lower diabetes rates."

But their main goal was to bring in more money, which they said would "fund early childhood

education" and "help a lot of families." [...] Store owners hated the new tax. "Bad tax!" said

Melvin Robinson, who runs Bruno's Pizza. He says few customers now buy soda from him. [...]

As with most taxes, the soda tax had an unintended consequence: Alcohol sales rose 5%.

"People buy more liquor," I shout at Greenlee. "Less Coke, more liquor!" Greenlee laughs and

says, "We have a liquor tax, too!"

Gotham's

Airheaded Carbon Law. On Earth Day 2019, then-mayor Bill de Blasio signed the Climate

Mobilization Act (Local Law 97) into law, heralding a Green New Deal for New York City. The

measure, committing the city to full carbon neutrality by 2050, represented the most aggressive

urban climate-change plan in America. Its centerpiece provision seeks to cut greenhouse-gas

emissions from buildings, a source that constitutes two-thirds of the city's total emissions. "In

one of the great coastal cities of the world, there's a lot we have to do to make sure that life in

2050 will be livable," preached the mayor. Local Law 97 won't make life in New York more

livable in 2050. On the contrary, starting next year, when its harsh penalties take effect, the

law will further raise costs in the world's priciest housing market, force middle-income New

Yorkers to subsidize green industries, and — by discouraging newcomers and driving away

existing residents — displace emissions to less carbon-efficient jurisdictions. In

exchange for nearly three decades of New York sacrifices, LL97 will reduce global climate emissions

by an infinitesimal amount.

Federal

revenue falls $416 billion from this time last year despite passage of IRA. Federal

revenue dropped $416 billion compared to this time last year, according to recently released U.S.

Treasury Department data, despite the Democrats' passage of their $780 billion Inflation Reduction

Act last year. The legislation, which President Biden signed in August 2022, contained a 15%

minimum corporate income tax, which still hasn't been fully implemented by the IRS. Experts at

the Committee for a Responsible Federal Budget and the Tax Foundation told Just the News that most

of the revenue raising provisions in the IRA have not taken effect yet but they likely won't raise

much revenue given the price-tag of the energy-related tax credits in the bill. "When they do,

they'll raise tens of billions a year — not hundreds of billions — much or

all of which will be countered by reduced revenue as a result of the IRA's energy tax credit," said

Marc Goldwein, senior vice president and senior policy director at the CRFB, on Monday.

Democrats'

proposed wealth tax spells doom for entrepreneurs and economic growth. A group of

far-left lawmakers has introduced yet another bill to soak the rich. The new bill is called

the Oppose Limitless Inequality Growth and Reverse Community Harms Act — the OLIGARCH

Act, get it? It would introduce an entirely new tax on wealth above $120 million, starting

at 2% and climbing to 8%. This new tax would be in addition to the income tax.

Rep. Barbara Lee (D-CA) claims the legislation is designed to "tax extreme wealth, reduce

inequality, and combat the threat to democracy posed by aristocracy." But it would more

accurately be described as an economic devastation bill. Indeed, it should alarm

anyone who wants to start a business, build up wealth for retirement, leave an inheritance for

their children, or just see the economy grow for everyone.

Democrats

demand 1,000% excise tax on 'assault weapons,' high-capacity magazines. More than two

dozen House Democrats put forward legislation Friday that would slap "assault weapons" and

high-capacity magazines with a 1,000% excise tax, a change that would raise the price of a $500

weapon to $5,000 in a bid to reduce access to guns across the country. Rep. Don Beyer,

D-Va., and 24 other House Democrats introduced the legislation Friday. It's the second time

Democrats have put forward the idea. Beyer and 37 Democrats proposed the same idea last year

when Democrats controlled the House, but it never moved.

The

True Definition of Socialism. Taxation is the sword and tool of socialism. It

is the fasces of socialism. The U.S. had no income tax until 1913. By 1926, in the

Roaring Twenties, unfettered capitalism had brought prices down so low that one person, earning the

average wage of only $1.24 per hour, could pay off his home in five years, purchase a vacation

home, pay that off, and support a family of five all the way through college. Note that our

vacation home boom in resort towns occurred at that time. So what happened? Why is our

goods-to-price standard of living so much lower and still declining each year? Franklin

Roosevelt increased income taxes for the poor in the lowest income bracket from 4 to 24 percent,

in the highest bracket to 94 percent (reducing what we could afford to pay), and corporate taxes to

40 percent (increasing the price we must pay). This is nonviolent socialism at full

throttle. We became a hybrid capitalist-socialist nation. Franklin Roosevelt had

completed the transformation of the Democrat party into a socialist party, and their occasional

moniker is "progressives."

California

and New York lose $640 million of tax revenue to migration, as conservative Florida and Texas see coffers

boosted by $23.1 billion. California and New York have lost a combined $640 [million] in

tax revenue due to people moving out-of-state, as conservative Florida and Texas see boosts of $23 billion

after an influx of movers. The two states currently top the table with the largest net negative tax

income migration, with The Golden State taking the top spot. In total, California has seen

$343 million leave the state, while New York is just under $300 million.

Biden's

Awful Plan To Raise Your Taxes To Support Global Socialism. The Biden administration

has just spent two years negotiating with a group of foreign countries to raise taxes on U.S.

companies operating overseas. Now we're being told it's been "delayed" for two more

years. But why delay a bad decision? It's an awful idea that should be rejected out of

hand. "Americans have already been crushed by inflation caused by the Biden administration,"

argued West Virginia congresswoman Carol Miller, in a recent op-ed. "But now, they want to add

fuel to the fire by giving American taxes to foreign countries, raising costs for Americans, and

sticking us with the bill for funding a global socialist agenda." Her analysis is spot

on. The U.S. Treasury and White House have no business negotiating a deal to subvert

America's sovereignty and erode its economic power, which the accord with the 38-nation

Organization for Economic Cooperation and Development (OECD), headquartered in the ultra-deluxe

Château de la Muette in Paris, is clearly meant to do.

Seven

Truths to Unmask the Regressive Left. Inflation is stealing your standard of living;

as Thomas Sowell said, it is a "quiet but effective way for the government to transfer resources

from the people to itself, without raising taxes." Do you any longer doubt why the government

knowingly and dramatically inflates the money supply? It's evident that some in government

and academia want the U.S. economy to tank. No economic metric affects everyone so broadly as

inflation. The government simply determines how much more to take from you to compensate them

for inflation's damage. The government is always made whole; are you? It borrows

against our children's future. We have no comparable ability to seize wealth, as does the

government — a demonstration of unrestrained evil in action.

Start

Walking: NY Cleared to Impose $23 Levy on Drivers Entering City. Democrat-run New

York City is ready to hit residents and visitors alike with a "congestion charge" after federal

approval was granted Monday for its first-in-the-nation plan to impose big tolls to drive into the

most visited parts of Manhattan. The program could begin as soon as the spring of 2024,

bringing New York City into line with places like London, Singapore, and Stockholm that have

implemented similar tax impositions on drivers simply going about their everyday business.

The news was announced within hours of NYC officials ordering pizzerias that use coal or

wood-burning ovens to slice their carbon emissions by 75 percent or else face hefty fines,

all in the name of protecting the environment.

Great

Reset: Macron Suggests International Taxation System to Subsidise Green Agenda.

French President Emmanuel Macron has suggested the imposition of a global taxation system in order

to subsidise the green agenda to mitigate climate change. Speaking at the Summit for a New

Global Financing Pact in Paris on Friday, Mr Macron argued that actions from individual governments

would be insufficient to deal with the alleged armageddon set to descend upon the world and

therefore a new international taxation framework should be established. "I'm in favour of an

international taxation to finance efforts that we have to make to fight poverty and in terms of

climate [action]," the French president said in comments reported by POLITICO.

A

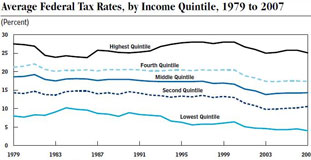

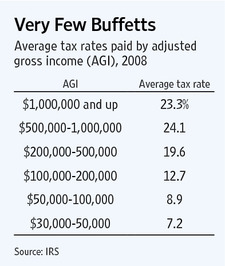

Look at Society Shows an Orchestrated Decline. The majority of us, the

middle-incomers, pay less than a third of the income tax revenue. The top 20% pay over

two-thirds, and the bottom 20% pay less than 2%. Yet, we constantly hear how the rich don't

pay their "fair share." How much should they pay? 75%? 100%? Too often, there

is little (if any) rational and unemotional discourse, and greedy whims end up dictating policy,

facts [notwithstanding]! After all, our betters know best. Such is the root of

political demagoguery amplified endlessly, to our detriment.

Taxation

Without Representation Meets the 21st Century. Following the outbreak of Covid-19 in

2020, government orders forced millions of employees to work from home instead of at their usual

offices. These orders accelerated a trend which had already begun toward remote and hybrid

work and — three years later — is all but entrenched. While some

companies have begun requiring employees to return to the office, the outdated ways of packing

folks into tight cubicles in downtown high rises will never be the same. [...] Most Americans pay

state and local income taxes based upon where they reside. Accordingly, the shift to remote

work made no difference to their tax liability. But some employees are subject to commuter

taxes, which are assessed based upon where the work itself is performed. Commuter taxes raise

their own public policy concerns — after all, commuters have no say in how those tax

dollars are used because they cannot vote in those jurisdictions.

CPS

will use its taxing authority to increase property taxes 5% in Chicago to help funding.

[Thread reader] At this rate, CPS and the city will just own all our houses soon. In the private

sector, when demand for your product or service declines 20% over a decade, you usually get some sort

of restructuring that includes right-sizing costs. But in the public sector? [...] To be clear,

I appreciate and respect teachers. My wife was once a teacher in CPS and I benefitted immensely

from quality public education. But it's fair to ask — as city tax payers —

what we're getting in return for this spending increase.

Colorado

Democrats Play Tax Games. Ever since the state turned Blue, Democrat politicians have

been trying to get at the Taxpayer Bill of Rights (TABOR), which is in the Colorado Constitution.

They are at it again. This time, Democrat legislators and Governor Jared Polis seem to be trying

to trick voters into giving away TABOR refunds they are due to get a little property tax relief.

Recently, Coloradoans received property value estimates that show property taxes will go up

substantially, even by 30 to 70 percent.

No,

a 'Fair Tax' is not a good idea. Let's take a look at the "Fair Tax" and see how fair

it really is. Yes, it would tax health care and health insurance. Why would people

think United Health Care, Aetna, and other very profitable companies would not only not pay income

taxes or payroll taxes, but would also be somehow exempt from the fair tax as well? Almost

everything would be taxed, or else they wouldn't collect the money the federal government

supposedly need.

Four

Officers Hurt, 6 Teens Arrested After Massive Brawl At Six Flags Theme Park. Four

police officers were injured and six teens were arrested after a fight erupted at Six Flags Great

America on Memorial Day. Gurnee Police Department (GPD) were called to the amusement park at

approximately 7:15 p.m. on May 29 for a report of a fight, the department said in a press release

the following day. "Witnesses claimed the fight started between two groups inside the park,

near the front gates, and spread to the parking lot," the GPD said.

Goodbye,

Minnesota. I was born in Minneapolis, graduated from the University of Minnesota and

have lived in the Twin Cities essentially my entire life. [...] This year, though, I'm moving my

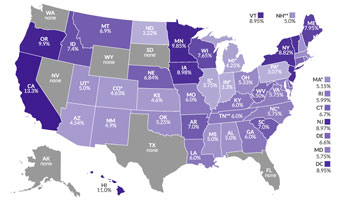

residency to Florida. [...] Those reasons start, but don't end, with taxes. Even in the face

of a massive $17 billion surplus, the Minnesota Legislature just raised my sales tax and gas tax,

created a new deliveries tax and even flirted with raising my income tax. Minnesota already

has the sixth-highest income tax rate in the country at 9.85%. Contrast that with Florida, which

has no state income tax. Even so, I could remain comfortable paying around 10% of my net

income to Minnesota if I was confident the money would be wisely spent and the rate relatively

constant. But the current trifecta of DFL control in St. Paul boasts that taxes are a

"wonderful tool" to fund their new massive growth in state spending on programs like "free" college

tuition, which won't be free to me.

The

Absurdities of Our Age. The top federal income tax rate is 37 percent. In

California, to take the example of our largest state, the top state bracket is 13.3 percent.

Income subject to federal payroll taxes is 15.3 percent for the self-employed — and

income subject to that crushing take is a whopping $160,200. The above taxes are well aside

from capital gains taxes, sales taxes, property taxes, and fuel taxes, which, along with income

taxes, can easily take 50-60 percent of one's middle-class income. Note that the government

not only does not appreciate the crushing extractions but targets for auditing those who pay at

that rate. And all this tax revenue leads to what? Multitrillion-dollar budget deficits

and unsustainable national debt.

Chicago,

RIP. Electing Lori Lightfoot as Mayor of Chicago was the beginning of the end for

that city. Replacing her with someone even more far left is accelerating Chicago's terminal

decline. Tom Bevan notes that the death throes are under way: [Tweet] The stupidity is

hard to fathom. A "head tax" on employees means less employment. The tax on jet fuel

will fall, I suppose, on all who fly into or out of O'Hare or Midway airport — yet

another reason to avoid the city. A 3.5% income tax that goes all the way down to $100,000 in

income is suicidal. I have no idea how the city plans to implement a "wealth tax," but it

sounds as though a household with a net worth of just $1 million would pay another $4,000 a

year. And the transaction fee will drive banking and investment firms out of the city.

In short, the plan, if enacted, will be a disaster.

Why